The Sol SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the April 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

PROJECT FINANCE STATISTICS

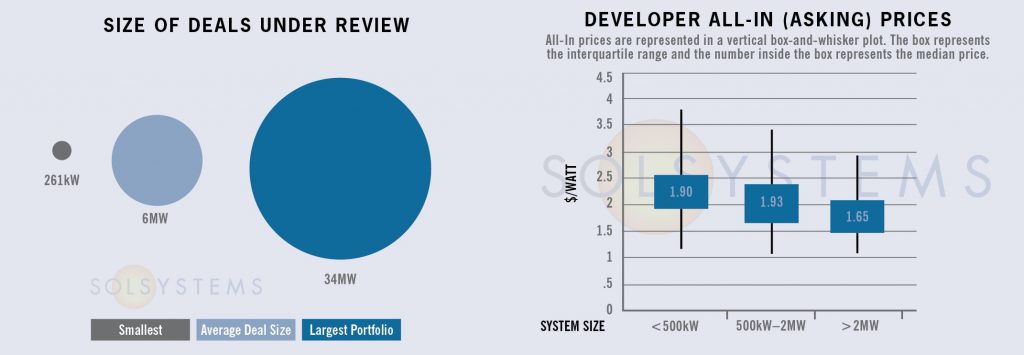

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

STATE MARKETS

Connecticut – Add Connecticut to the list of states looking to increase their renewable portfolio standards if the renewables boost is paired with support for nuclear. Connecticut is currently considering a 40% by 2040 goal, and if SB 106 makes it to the finish line, Connecticut will join a growing number of states such as Rhode Island, New York, D.C., and Oregon that have a 40 or 50% renewable portfolio standard (RPS). SB 106 would also extend the state’s solar program – the LREC and ZREC programs – for another year, and provide support to struggling nuclear facilities via 5-year power purchase agreements. If the nuclear provisions are too controversial for lawmakers, another legislative vehicle, SB 860, would extend the ZREC and LREC programs – without the nuclear support.

While the extension to the respective solar programs is expected to be short-term, we’ve got our eyes on the long-awaited Comprehensive Energy Plan. We are hopeful that the Plan will provide a long-term vision and pathway for renewable energy in Connecticut, rather than the boom and bust, “hurry up and wait” marketplace that has been created by the annual ZREC auctions. Developers and interested solar customers in Connecticut, stay tuned!

Illinois – Watch for Illinois to be the breakout solar market of 2018. After passing the Future Energy Jobs Act (FEJA) – an omnibus energy bill to fix the state’s 25% renewable portfolio standard – in late 2016, the Illinois Power Agency must now begin to implement the law. FEJA could generate as much as 1.35GW of new solar build in the Land of Lincoln by 2020; for reference, only 5MW were built in all of 2016, and only 70MW have been installed to date. The new law incentivizes distributed generation (<2MW) through an Adjustable Block program that will open in mid-2018; the Adjustable Block provides 15-year REC contracts to residential, commercial, and community solar projects. Utility-scale projects (>2MW) will also be eligible for 15-year REC contracts through procurement events; the first will take place in August 2017.

Ohio – Here we go again. After a defeat in 2016, the Ohio legislature is trying yet again roll back its modest 12.5% renewable portfolio standard. Last year, more than 135 witnesses testified against similar legislation, and the Governor ultimately vetoed HB 544, noting that the roll back to the standards would have created “self-inflicted” damage to the state’s economic competitiveness. Unfortunately, however, the House voted to make the RPS voluntary, a move that would remove any “teeth” from the RPS. Governor Kasich has maintained the position that he would veto such legislation if it makes it through the Senate.

Governor Kasich was the third Midwestern Republican governor to support local renewable energy investment this past December. Illinois Governor Rauner signed a massive RPS bill in early December, and Michigan Governor Rick Snyder signed a modest increase to the state’s RPS shortly thereafter. This year, Minnesota Governor Mark Dayton (D) vetoed anti-solar legislation, and Michigan and Iowa are both revising their PURPA methodologies, which could spur further solar development.

While the Ohio legislature looks backward, much of the Midwest is looking to spur economic development with solar, an industry that now employs 260,000 people across the country. The solar industry employs more than twice as many Americans as the entire coal industry and just as many Americans as the natural gas industry.

The Ohio anti-renewables “debate” has been largely ideological, with some rhetoric focused on the cost of compliance. However, data from the Public Utilities Commission of Ohio has shown that the RPS costs ratepayers an average of 29 cents per month.

SOLAR CHATTER

- What’s in store for storage? In Massachusetts, the Massachusetts Clean Energy Center and the ever-industrious team at the DOER, have opened $10MM in grant funding for storage projects. Applications are due June 9, and individual projects can be awarded up to $1.25MM each. Over 100 entities submitted formal Expressions of Interest to the program administrators last month. In California, the Self-Generation Incentive Program will begin accepting new applications on May 1. In Maryland, legislation to provide tax credits for residential and commercial storage has passed and awaits the Governor’s signature.

- The market for modules continues to be oversupplied given competition from rest of world manufacturers and China’s stepdown in its tariff. To compete, more module manufacturers are driving up wattage sizes and efficiencies to reduce overall system costs, and to make space-constrained sites more feasible. Module manufacturers are rapidly introducing new features such as bi-facial capabilities, laminate modules, half-cell configurations, and the alike, as ways to differentiate their products and give more flexibility to the market to pick and choose technologies based on site specific conditions. We expect these market transformations to continue to drive down module costs.

- We’re hopeful that Southern California Edison’s megawatt cap on the Option R rate will be lifted. The current cap on the program is 400MW, which could be hit as soon as next year. What’s Option R? We provide you with this throwback from 2015 as a primer. In short, Option R is a “solar-friendly” rate for the commercial and industrial solar sector in Southern California. In other California news, we’re still watching for the next iteration of LADWP’s feed-in tariff.

- Tax equity financing in the utility-scale solar market is shifting. We’ve noticed that smaller projects (say, minimum 2MW AC instead of 5MW AC) are seeking tax equity, as there are fewer markets where larger projects can receive long-term PPAs outside of PURPA. Some state incentive programs in states like Massachusetts, Colorado, and Minnesota also cap individual project sizes.

- The solar industry has ambitious megawatt goals over the next several years, but if other generating plants are not retired and our nation’s electricity demand does not grow, who’s going to buy all of the power? All solar energy companies – and not just the residential companies – must focus on capturing customers, and giving customers the ability to choose their power. Residential and C&I consumers are the vanguard of the clean energy movement, and will continue to drive demand and inspire change.

- Insurance companies continue to be one of the quieter – but most prominent – renewable energy investors. Most recently, Exelon sold nearly half an interest in a 1.3GW renewable generation portfolio to John Hancock Life Insurance Co. for $400 million.

- Want an excuse to travel to Colorado? The Medium Solar*Rewards incentive program for projects <500kW opened on April 10. 6MW are available this quarter. The next program window will open in July.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 595MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.