The Sol SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the May 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

PROJECT FINANCE STATISTICS

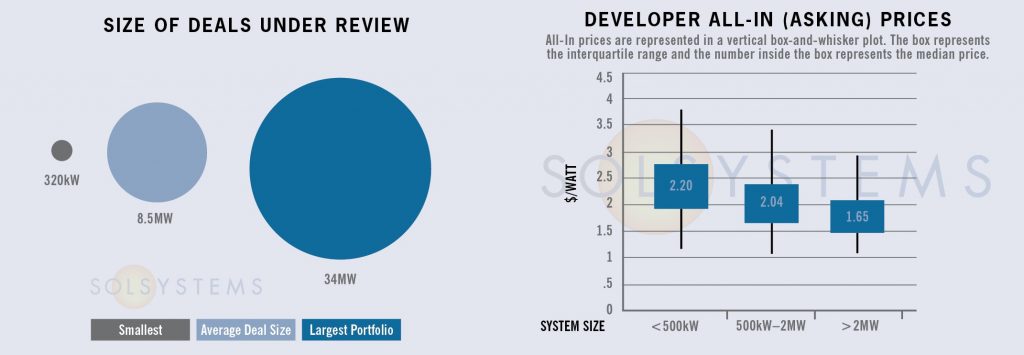

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

Have a solar project in need of financing? Our team can provide a pricing quote for you here.

STATE MARKETS

Maryland – Spot market pricing for solar renewable energy credits (SRECs) has fallen to $8.50/SREC. While industry-backed legislation to increase the solar carve-out to 4% failed quickly – largely because it came on the tails of an RPS veto override – other legislation provides the industry with some hope. Notably, the Renewable Energy Portfolio Standard Study legislation (HB 1414) requires the Power Plant Research Program to study the cost and benefits in the Maryland RPS, long-term contracting and procurement options, and the availability of renewable energy resources in the region.

Will the study help tee Maryland up for a more ambitious RPS? We sure hope so, as does the Chesapeake Climate Action Network (CCAN), who recently started a 50% by 2030 RPS campaign. If passed, a 50% RPS would put Maryland on par with other leadership states such as New York, Oregon, D.C., California, and Vermont. Unfortunately, improved market conditions will take some time; the study is not due until December 2019, though an interim report is due at the end of 2018.

In addition to low SREC prices, county moratoriums and bans on greenfield development on agricultural land make it challenging to find suitable sites for aggregate net metering, community solar, and other solar development opportunities.

While Maryland has been a leader on the East Coast for solar deployment, unfortunately, we do not expect the state to experience the same commercial and utility-scale market growth that it has seen over the past several years.

Oregon – Oregon had a bang-up 2016. In total, 150MW were installed, which is over half of the solar installed in the state to date. Most of the growth to-date has been in the utility-scale market given favorable PURPA contract terms. Additionally, after the passage of Oregon’s 50% by 2040 RPS last year, solar projects in the 2-10MW range take advantage of a short-lived 5-year $.005/kWh incentive, a nice economic boost in a low-PPA state for those projects that could get it.

While utility-scale is booming, the commercial market lags behind. Energy Trust Incentives exist for projects up to 100kW in Pacific Power territory and up to 250kW in PGE territory. According to SEIA, the biggest corporate project in the state is a 497kW Ikea project, likely a cash purchase.

The Oregon Solar Energy Industries Association (OSEIA) has set an ambitious 10% by 2027 goal to bolster the market and is currently discussing policy tools to help them get there (read the Oregon Solar Plan for more details). In the interim, though, what’s next? For one, OSEIA is working to implement its community solar regulations. Rules will be finalized by July, and projects can be 3MW in size. Outstanding issues in implementation include the bill credit rate, whether subscribers may only subscribe to projects in their service territory (this could preclude PGE from participating), and whether the low income requirement will be per project or as a percentage of the program.

New York – New York’s solar market has faced some scrutiny in the press after the Solar Jobs Census showed that the Empire State was one of the few states that lost solar jobs in 2016. While solar industry employment grew by 25% last year, New York lost 800 solar jobs.

The Solar Foundation blamed the job losses on regulatory uncertainty – namely the Value of Distributed Energy Resources (VDER) proceeding – which has created a lull (and a lot of uncertainty) in the market for the commercial and industrial (C&I) sector. Residential customers are grandfathered under net metering. (Need a refresher on VDER? Here’s our summary following the March order.) This uncertainty will remain until later this summer when final components of the Phase One value stack are announced, though given the overcomplication of VDER and variability of critical value stack components, implementation could be challenging. The National Resources Defense Council phrased it well, calling VDER a “dizzying array of acronyms.” After Phase One comes the regulatory proceeding for, you guessed it, Phase Two, which is expected to be finalized by late 2018.

Our heart goes out to those companies without full-time Government Affairs staff, which is, well, most of the solar industry. How long will it take local and regional players to adjust to this new, complex regulatory framework?

Meanwhile, the New York Megawatt Block program – which we wrote about extensively prior to its launch – has yielded distinctly underwhelming results in the C&I sector, more or less as we predicted. While the dashboard shows 1.1GW reserved, only 309MW of non-residential solar has been built in NY – and about 200MW of that predates Megawatt Block. When faced with this, NYSERDA points to its queue of projects as a marker of success. But if the program fails to live up to its potential and those megawatts are not installed, what happens next?

Under Government Cuomo, New York has proven that it has the political will and vision to lead nationally in solar energy deployment. Recent forced churn in the state’s interconnection queue was clarifying and well thought out, though many very elderly applications remain. We were encouraged to see Peter Olmsted, an in–the–weeds policy designer formerly of Vote Solar, be promoted to Assistant Secretary for Energy in the Governor’s Office. We are also hopeful that Phase Two of VDER will look closely at issues in Phase One with an eye to problem-solve. Ultimately, the simple fact is that an incentive reboot or uplift of some kind will have to be contemplated to see significant deployment near term. NYSERDA has hinted that they are contemplating adjusting the Megawatt Block program. However, this has not provided any guidance or timeline for when these changes may occur.

Additionally, the PSEG Long Island Small Commercial Megawatt Block project incentive cap will increase from 200kW nameplate capacity to 500kW. Long Island has significantly higher electricity costs than the rest of the state. Combined with this change, PPA projects could be significantly more successful in this part of the state, if developers can find the right site to make this work.

SOLAR CHATTER

- Are…you…ready!? After long last, we are expecting updated draft guidelines from the Massachusetts Department of Energy Resources (DOER) on SMART, the successor program to SREC II, at the end of May. Stay tuned for updates in June’s SOURCE, and don’t forget to knock on wood.

- Corporate renewable energy procurement is the industry’s hottest trend, and the industry’s favorite buzz word (ok, maybe that’s community solar). The importance of corporate procurements in driving long-term growth of the renewable energy sector cannot be underscored. As more developers hope to take advantage of these opportunities, RFPs are, unsurprisingly, maximally competitive to the point where developers with only modest or perceived manageable nonperformance downsides (in the form of modest bid bonds or lengthy periods before COD is required) may be "betting on the come." We’re seeing a fair amount of situations where developers obtain an RFP win, and then sit on it for 18 months, using the customer’s PPA award as the license to seek out financing, complete development, and hope that EPC prices come in with an upside surprise. We advise would-be buyers to demand interim milestones, significant security on award, and plenty of execution information when assessing a developer’s viability.

- Did you know that Delaware was ranked 5th in solar installations per capita in 2012? The solar market is no longer booming, but the residential market continues to grow modestly. The next solicitation for the SREC Delaware program, which grants 20-year SREC contracts to eligible solar energy systems, will open for bids on May 29.

- Property taxes are as taxing as ever for the solar industry, especially in the Southeast, and especially in the form of personal property taxes, which disproportionally impact renewable energy resources (high capex, low opex) as opposed to fossil. There’s a bright spot in the Sunshine State, where property tax abatement legislation passed unanimously and now awaits the Governor’s signature. Similar efforts are on hold in South Carolina, unfortunately, as property tax legislation - 44 – is pending until 2018. Nonetheless, we still see promise in the South Carolina utility-scale market.

- The Connecticut LREC and ZREC programs have been announced for the year. Bids – including firm pricing – are due on June 8th. Sol has experience with this program and can advise on winning bids. Contact us at finance@solsystems.com for more information. Meanwhile, pending legislation to increase the RPS and extend the LREC / ZREC programs is still pending in the legislature.

- In power forecasting, the merchant power "tail" wags the We find that investor estimates of the value of post-PPA power are more powerful than yield or return expectations. Given that, and 20-year forecasts are just, well, forecasts, this dynamic may drive the market toward its most natural investor: those with long-tenored obligations who want a boring, low risk long-tenored asset. A buy-and-hold investor will tend to see their yield converge over the long term no matter the forecast they believe… though its Y20 output may vary somewhat.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 600MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.