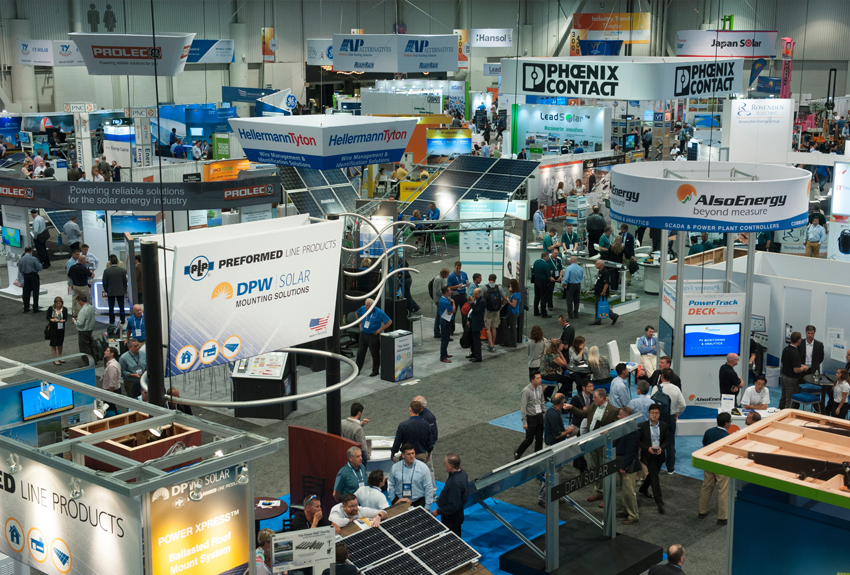

Solar Power International (SPI) is, without a doubt, the solar industry event of the year. This year, nearly 20,000 solar industry professionals flocked to Vegas for SPI 2017, a week to reunite with solar colleagues from across the country. SPI is a sprint full of dehydration, sore feet, exhaustion, high step counts, meetings upon meetings, and even a deal or two if you’re lucky. While the educational panels are helpful in providing context on key issues, the networking, meetings, and even walking the show floor are even more so. Above all, SPI is an opportune time to take the temperature of the industry. Here are a few of our key takeaways from SPI 2017.

- The elephant in the room: Section 201 case – SPI is a great place to take the pulse of the solar industry. After a very high-profile bankruptcy and some rocky headlines for some of the publicly traded companies last year, SPI 2016 was very low energy, with a bit of a shadow cast over the show (and not just because one of those publicly traded companies was not around to throw SPI’s biggest party).This year was different. Despite the Section 201 case, the energy was high, showing once again that the industry is resilient. Many were resigned to (and predicted) the September 22 International Trade Commission (ITC) injury finding, and the national Solar Energy Industries Association (SEIA) is ready to fight for us through the next round. You might summarize the sentiment of SPI 2017 as: “the solar coaster: ride or die.”

- Mo’ Money, No Projects – Despite the trade petition, it is clear that new funding sources are entering the U.S. market, and it was clear from the show that there is more capital interested in investing than project pipeline right now (see more on how this has happened in the tax equity market in the August SOURCE). The supply-demand balance has been upset due to a combination of market volatility (i.e. a certain residential and commercial solar developer switching to focusing on cars, storage, and roofs), and state-level policy changes. Many states are transitioning to a new solar regime (Massachusetts), stalled (New York due to the messes of both VDER and Megawatt Block), or completely new and under development (Illinois). Projects on the market are typically smaller than an investors’ 1MW threshold, or need to get done right away.

- The Midwest is heating up – One region in which new projects are emerging is the Midwest. While we have been singing the praises of Illinois since late last year, other non-traditional markets are emerging due to falling costs and changing consumer interests. The cat’s out of the bag on the Midwest, but could this change if tariffs are imposed on foreign made panels?

- Will PURPA’s reign continue? – PURPA has been a boon to the small utility-scale solar market, especially in places such as North Carolina, South Carolina, and Oregon. We enjoyed the PURPA Reign panel – especially the engagement from some of the utilities, which showed the debate over PURPA is much more complicated than solar professionals think. But, is PURPA really changing? While some markets, such as North Carolina, are reforming their PURPA laws, others, such as Michigan, are emerging. It’s clear that this battle, like net metering and so many others in the solar industry, will be debated state-by-state, and the outcomes are largely dependent on who is present at the table.

- Corporate PPAs – Corporate renewable energy procurement has been the industry buzz term of 2016 and 2017, but how many deals will actually be done in 2017 and 2018? Not as many as should be, we think. We confirmed with several developers at SPI – and even utilities interested in corporate renewables – that RFPs for these offsite transactions have become a race to the bottom, with developers bidding at too-good-to-be-true pricing to win these deals. Will these projects come to fruition? Hard to say, but we are predicting project attrition. We expect it will take some of these deals to fall apart for corporate buyers to have a better understanding of the reality of some of these deals.

- Bifacial modules: on the rise? – More manufacturers than we expected were displaying bifacial modules. Bifacial modules could be like trackers, which are slightly more expensive, more risky, harder to model, and location-dependent, but they also provide an increase in yield. They also enable certain roofing costs to be included for the purposes of the ITC and depreciation. Will they soon dominate the market in many places? It’s too early to tell, but they were certainly prevalent at this year’s show. Read more in August’s SOURCE.

This is an excerpt from the September 2017 edition of The SOL SOURCE, a monthly electronic newsletter analyzing the latest trends in renewable energy based on our unique position in the solar financing space. To receive future editions of the journal, please subscribe.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered 650MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.