See below for the July 2023 edition of the Sol SOURCE. Make sure to sign up to receive future editions as they release.

The Sol SOURCE – July 2023

The Sol SOURCE – July 2023

Recent Articles...

A Farm Less Ordinary: At the Intersection of Inclusion and Sustainability

Sol Systems Sets the Standard: Beyond Carbon Neutral in 2023

The Sol SOURCE – March 2023

The Sol SOURCE – March 2023

See below for the March 2023 edition of the Sol SOURCE. Make sure to sign up to receive future editions as they release.

Recent Articles...

A Farm Less Ordinary: At the Intersection of Inclusion and Sustainability

Sol Systems Sets the Standard: Beyond Carbon Neutral in 2023

After the Inflation Reduction Act: Solar’s New Horizon

After the Inflation Reduction Act: Solar’s New Horizon

This article is part of the March 2023 edition of our publication The Sol SOURCE. Click here to read the full publication.

After the excitement that followed passage of the Inflation Reduction Act (IRA), reality is setting back in as we await implementation guidance from the Biden Administration. However, clean energy isn’t the federal government’s only focus—2021’s Infrastructure Investment and Jobs Act (IIJA) has started to take effect, not to mention the continued war in Ukraine, increasing trade and tensions with China, and a tumultuous U.S. economy made even rockier by the recent collapse of Silicon Valley Bank and ongoing uncertainty about the debt ceiling. Analysts, investors, and state governments are setting new expectations for clean energy deployment as we all dig deeper into the challenges and opportunities ahead.

New Law, New Projections

The IRA’s effect on solar growth projections is unmistakable. The Solar Energy Industries Association (SEIA) projects a 69% increase in solar deployment over the next 10 years, which would lead to five times more solar in the ground. 85 GW of new solar manufacturing capacity have been announced since the IRA was signed—an 870% increase. With annual overall investment in renewables set to increase from $64 billion in 2022 to $116 billion in 2031, the U.S. is now projected to cut its economy-wide emissions by more than 50% by 2030.

The End of the Solar Coaster

The unprecedented scale of these projections is largely driven by the new longevity of federal clean energy tax credits under the IRA. For the first time, the ITC and PTC will persist at full value for 10 years—or longer, if emissions from generation aren’t reduced by at least 75% in that time. The longer horizon is intended to encourage sustained investment in clean energy, instead of the too‑familiar boom-and-bust cycles brought on by periodic one- and two-year extensions. Under the IRA, the credits also transition quickly to technology-neutral clean energy credits, aligning with scientists’ and policymakers’ focus on emissions outcomes rather than technological inputs.

States Step Up

While we await federal guidance for implementing novel portions of the new law, state governments are stepping up to make the most of this moment. Encouraged by the new federal attention on clean energy that we saw in 2022, a number of states have passed or are studying 100% clean electricity commitments. As we highlight in our State Markets section, since the IRA was signed, Minnesota and New Jersey have made fresh commitments to 100% clean electricity, marking the first time that more than half of Americans live in jurisdictions that have made this commitment. States are also looking ahead at how they can leverage a clean electricity supply to decarbonize other sectors, such as transportation and building operations. The IRA and IIJA’s significant investment in these harder-to-decarbonize sectors is largely funded through states, making their role particularly important.

New Challenges

Portions of the IRA’s larger and longer-lasting tax credits rely on further federal guidance for their implementation. Because of the limits of the budget reconciliation process under which the IRA was passed, the law itself could not include the specific instructions needed for implementing its novel credit adders and financing options. Rules and definitions related to domestic content, energy communities, credit transferability, and direct pay are left to the IRS and other federal agencies to develop before the credits can be monetized. For example, the IRA incentivizes building clean energy infrastructure in “energy communities,” defined by their proximity to Superfund sites or recently closed coal facilities, or by lost fossil fuel employment. Each of these criteria requires additional information from the IRS to be actionable—defining census tracts, proximity rules, and so forth.

Another key hurdle to fulfilling the promise of the IRA is a challenge facing many industries in 2023—finding enough workers. According to some estimates, more than 100,000 new clean energy jobs have been created in the six months since the IRA took effect. At the same time, the U.S. construction industry was short 413,000 workers as of December, while 764,000 manufacturing sector jobs remained open, according to the Bureau of Labor Statistics. McKinsey & Company expects a further 550,000 new energy transition jobs by 2030, of which they estimate only up to 10% will be filled by workers leaving the oil and gas industry. Even with the significant support the IRA provides for apprenticeships, this issue remains potentially the most important challenge to achieving the full value of the IRA over the long term.

What Else Is Going on in Solar?

Setting aside the IRA, familiar policy topics remain in focus for the industry. International trade issues are still an important concern, including tariff policy and complications from our ever-evolving relationship with the People’s Republic of China. In the near term, we expect a final determination on the AD/CVD investigation by May 1, 2023, which will establish tariff rates for a substantial portion of solar panel imports. President Biden (D) stayed the effect of this decision through June 2024, although Congress is now considering overturning that critical near-term tariff relief and imposing retroactive tariffs, which would debilitate the industry. Purchasing decisions already stretch past the end of the tariff relief, and we look forward to better pricing certainty as we onshore manufacturing capacity. As we write this, solar panel imports have begun to unstick from the logjam that followed the Uyghur Forced Labor Prevention Act. Trina Solar, for example, noted that more than 900 MW of panels have cleared customs recently with less than one percent detained. This is a significant improvement from the effective freeze we saw after the law took effect last year.

Domestic challenges also remain. At the forefront are ever-worsening interconnection processes, which are hampering many regions’ efforts to connect new renewable generation. In PJM, which serves 14 jurisdictions from Pennsylvania to North Carolina to Illinois, grid operators worry that interconnection uncertainties may threaten future reliability. In the near term, the ongoing threats of federal default and bank insolvencies hang over investors and developers alike as the U.S. approaches the federal debt limit, currently estimated to be reached as soon as June. At the local level, an Astroturf campaign threatens to impose overly restrictive siting requirements for solar—if not outright bans—in many counties. Meanwhile, the State of Illinois recently passed a national model for streamlining siting requirements across geographies and technologies.

Recent Articles...

A Farm Less Ordinary: At the Intersection of Inclusion and Sustainability

Sol Systems Sets the Standard: Beyond Carbon Neutral in 2023

Clean Fuel Update – California LCFS Price Trends November 2022

Clean Fuel Update – California LCFS Price Trends November 2022

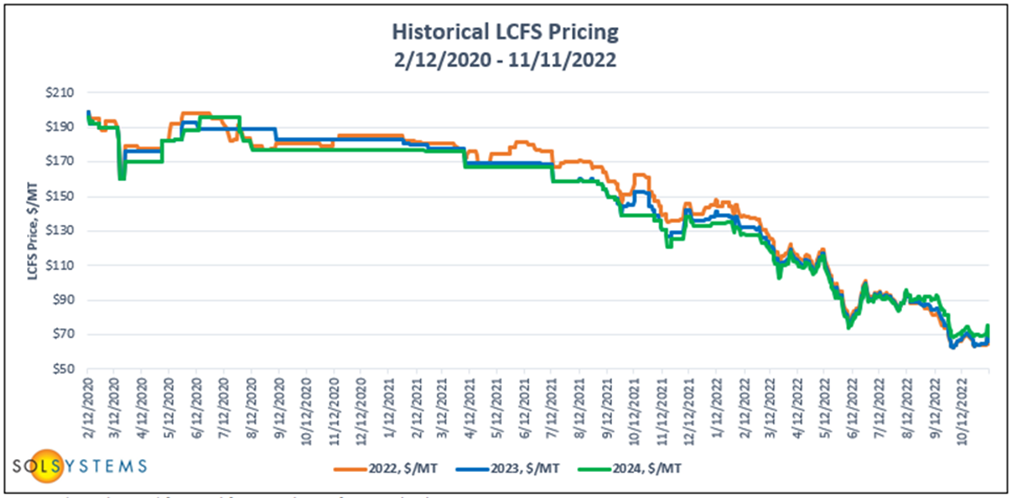

LCFS credit prices in California continue to plummet as supply outpaces demand. Current spot prices for immediate delivery are in the low to mid $60s, a ~30 percent drop from prices last quarter.

Similar to past quarters when the California Air Resources Board (“CARB”) held stakeholder convenings, the market did see a slight uptick on pricing following CARB’s November 9, 2022 meeting when pricing was around the $63-69 range. However, the uptick was short lived.

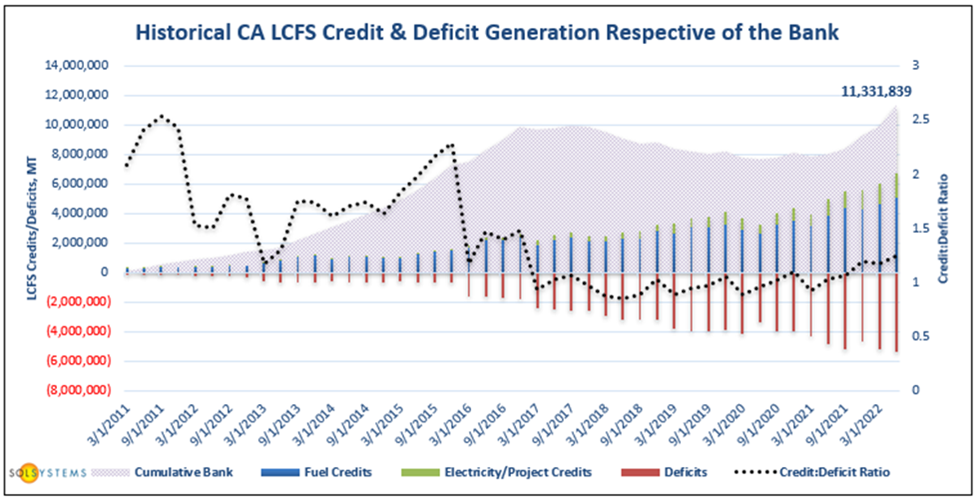

CARB’s Q2 2022 data posted on October 31, 2022 shows an all-time high of credits outpacing deficits with a surplus of 1.35 million metric tons of credits generated in Q2. The credit bank now sits at 11.3 million metric ton credits.

The downward spiral of LCFS pricing over the past year has impacted many stakeholders’ infrastructure development plans as well as LCFS credit monetization strategies. With regards to project buildout, developers and investors have been taking a more cautious approach, either delaying or halting projects altogether. For LCFS monetization, many market participants, particularly those in the electricity pathway, are re-thinking the cost-benefit analysis of utilizing renewable energy credits (“RECs”) to lower carbon intensity (“CI”) scores. In the past, there has been no question of whether purchasing RECs was worth it as the delta between REC purchase costs and LCFS revenue was large enough to make the REC investment pay for itself in multiples (i.e. despite the added REC procurement costs, market participants would generate enough additional LCFS credits from the purchase to come out ahead). As the delta shrinks, purchasing RECs may no longer be worth it. Where that threshold is will differ from participant to participant based on the vehicle type utilized, the energy economy ratio, and other factors. Sol Systems can work with clients to answer any REC related questions and determine what the optimal REC procurement strategy may be. This market dynamic may also put a downward pressure on REC pricing in CA.

This analysis was featured in the November 2022 edition of the Sol Standard, a quarterly newsletter that provides up-to-date pricing data, market analysis, and policy trends to keep clients up to speed on the country’s growing low carbon and clean fuels programs. To subscribe and access past editions of the The Sol Standard, fill out our subscribe form here.

Recent Articles...

A Farm Less Ordinary: At the Intersection of Inclusion and Sustainability

Sol Systems Sets the Standard: Beyond Carbon Neutral in 2023

The Sol SOURCE – November 2022

The Sol SOURCE – November 2022

Click here to read the full November edition of the Sol SOURCE.

The Sol SOURCE is a renewables journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains trends and observations gained through interviews with our team, incorporating news from a variety of industry resources.

Below, we have included excerpts from the November 2022 edition. To receive future Journals, please subscribe or email SOURCE@solsystems.com.

STATE MARKETS

California – Property tax exclusion extended to 2026 and new load management standards

On September 18, 2022, SB 1340, a bill to extend the property tax exclusion for solar to 2026, was signed by the Governor. California has seen several reversals of long-planned energy policy decisions this year, including efforts to keep its last nuclear plant open while shelving (for now) plans to recalculate net-energy metering (“NEM”). The California Public Utilities Commission (“CPUC”) issued a proposed decision that would delay a NEM 3.0 program to August 27, 2023.

On October 12, 2022, the California Energy Commission (“CEC”) adopted new load management standards to increase demand flexibility across the state. The new standards, which include requiring utilities to develop and offer retail electric rates that “change at least hourly”, will go into effect in April 2023. The changes are expected to reduce peak energy use and save customers $267 million over 15 years.

Connecticut - Non-Residential Renewable Energy Solutions draft decision released

On October 19, 2022, the Connecticut Public Utilities Regulatory Authority (“PURA”) released a draft decision on the Year 2 Non-Residential Renewable Energy Solutions (“NRES”) program (Docket 22-08-03). If adopted, the program’s overall capacity would be expanded from 60 MW to 110 MW and remove size-to-load provisions for commercial rooftop projects. A final decision is expected on November 9, 2022.

District of Columbia – RPS increase legislation introduced

The recently introduced Local Solar Expansion Amendment Act of 2022, which would maintain the Solar Alternative Compliance Payment (“SACP”) at $500/MWh and raise the solar carve-out from 10 percent to 15 percent by 2041, was heard on October 3, 2022. Multiple stakeholders provided testimony, voicing both support and concerns for the Act. Changes to the bill language are expected to address concerns arounds costs and feasibility.

There remains no official word on nominees for the DC Public Service Commission vacancy.

Illinois–Illinois Commerce Commission kicks off the Fall 2022 indexed REC procurement

Block 6 of the Adjustable Block Program (“ABP”) officially opened on September 1, 2022. At the same time, the Illinois Power Authority (“IPA”) circulated an updated program guidebook which can be found here.

The Procurement Administrator published the final indexed REC contract and RFP documents for the Fall 2022 indexed REC procurement. The RFP is for new utility-scale wind and solar projects over 5 MW along with any-size brownfield-site photovoltaic projects.

On the regulatory side, the industry continues to engage in ongoing proceedings related to the DG rebate and net-metering tariffs with Ameren and ComEd.

Maine – New England Clean Energy Connect on hold until next year

The Governor’s Energy Office has reconvened the distributed generation stakeholder group now that Maine’s legislative session has ended. The next meeting will take place on November 17, 2022. We expect a straw proposal later this fall to contain more successor program design details in advance of a final report due January 2023.

The New England Clean Energy Connect (NECEC) transmission project, which was the subject of a ballot measure approved by state voters in November, has been put on hold until April of next year when the case goes to trial. The NECEC project planned to carry electricity from Canadian hydropower through Maine and into Massachusetts.

Massachusetts – Finalized Clean Energy Standard amendments published

On August 11, 2022, Governor Baker signed omnibus energy legislation into law (HB 5060). Among other things, the law maintains an offshore wind procurement target of 5,600 MW by 2027 and creates an offshore wind tax credit. The law also addresses grid modernization and directs the Massachusetts Department of Energy Resources (“DOER”) to study a variety of energy storage programs. Furthermore, it requires that DOER include a pollinator-friendly solar incentive in the Solar Massachusetts Renewable Target (“SMART”) program or successor program, bans biomass from qualifying for the RPS after January 1, 2022, as an eligible RPS Class I or II technology, relaxes the net-metering cap, and mandates that all new vehicle sales in the state be zero-emission beginning in 2035.

On October 14, 2022, the Massachusetts Department of Environmental Protection (“MassDEP”) finalized amendments to the states Clean Energy Standard (“CES”) which include:

- Raising the rate of increase of the CES standard to 6 percent each year from 2026-2030 and lowering the rate of increase from 2031-2050 to 1 percent each year, reaching 80 percent in 2050.

- Increasing the CES-E stringency from 20 percent to 25 percent of 2018 retail sales starting in 2023.

- Setting the CES alternative compliance payment (“ACP”) rate at $35/MWh and the CES-E ACP rate at $10/MWh in 2022 through 2050.

These changes were made to align the CES with the 2030 Interim Clean Energy and Climate Plan (“Interim CECP”) and the Massachusetts 2050 Decarbonization Roadmap Report (“2050 Decarbonization Roadmap”) to accelerate the state towards fully decarbonized electricity.

New Jersey – Senator Smith introduces RPS revision bill

On April 26, 2022, BPU issued a Straw Proposal for the Competitive Solar Incentive (“CSI”). While there have been delays, the CSI program is still expected to launch later this year. The BPU is also expected to review ADI incentive levels as part of the one-year review. Legislation related to interconnection (S431), energy storage incentives (S2185), remote net metering (S2848), and the legacy SREC program (S439) moved through the Senate. On October 17, 2022, S2848 was reported out of Assembly Telecommunications and Utilities Committee and referred to the Assembly Environment and Solid Waste Committee. We expect all these bills to be heard in the fall.

Senator Bob Smith (D-17) introduced S2978 on August 8, 2022. As currently written, the bill would:

- Revise the RPS in New Jersey by applying the Class I standard to electricity sold in the State after subtracting electricity generated by existing nuclear and other zero-carbon sources.

- Require that at least 50 percent of RECs used to comply with the RPS be in New Jersey.

- Mandate that 100 percent of retail electricity delivered to New Jersey be from Class I sources by 2045.

The bill was scheduled for hearing on September 30, 2022, by the Senate Environment and Energy Committee but was pulled from consideration. We expect to see bill amendments from Senator Smith later this year.

Ohio – Public Siting Board proposes procedure revisions

On June 16, 2022, the Ohio Public Siting Board proposed procedure revisions, including one that would require solar setbacks of 150 feet from roads and unaffiliated properties and 300 feet from unaffiliated residences. Other proposals including public disclosure requirements for new facilities, codifying decommissioning requirements included in SB 52, and fencing requirements for solar sites. Initial comments were due on August 12, 2022, and reply comments were due on September 2, 2022.

Pennsylvania – Legislature approves hydrogen and natural gas tax credit bill

On October 26, 2022, HB 1059 passed both the Senate and General Assembly. The bill primarily focuses on state tax credits for hydrogen and natural gas, including $50 million annually for a federally designated regional clean hydrogen hub and $20 million in tax credits for to semiconductor manufacturing. The tax credit for using natural gas to make petrochemicals or fertilizer would also be increased by $30 million annually. Governor Wolf has until November 6, 2022 to sign or veto the bill.

Rhode Island - Department of Environmental Management changing REC accounting methodology

Earlier this month, the Rhode Island Department of Environmental Management (“RIDEM”) published a press release indicating the Department is looking at changing their renewable energy credit (“REC”) accounting methodology, specifically to account for greenhouse gas emissions. The current methodology used by RIDEM was developed from MassDEP. They are now looking to transition towards the model used by the Connecticut Department of Energy and Environmental Protection (“CTDEEP”) to ensure all RECs settled in Rhode Island are correctly counted towards the state’s electric sector.

Virginia – SCC requests additional comments related to the revenue-grade meter requirement

In March 2022, DEQ announced that it would define solar panels as impervious surface areas. On April 14, 2022, DEQ released additional guidance that pushed implementation out to January 1, 2025, for all projects that have not received interconnection approval. In July, DEQ released two additional stormwater guidance documents focused on stormwater management and erosion and sediment control. Comments were due August 31, 2022.

On October 3, 2022, Governor Youngkin unveiled his 2022 Virginia Energy Plan. Among other things, the plan calls for the Virginia Clean Economy Act (“VCEA”) to be reevaluated in 2023, and every five years thereafter. It also calls for the repeal of Virginia’s Clean Car Standard and for the state to exit the Regional Greenhouse Gas Initiative (“RGGI”).

On April 14, 2022, the Virginia State Corporation Commission (“SCC”) opened a docket to establish a self-certification process for small distributed generation systems seeking to qualify as low-income projects and consider additional GATS-related questions. On July 26, 2022, the SCC issued an order for additional comments in the docket. Staff issued their report on September 22, 2022. All stakeholder comments were due on October 20, 2022.

SOLAR CHATTER

- In yet another example of renewable energy’s incredible momentum, a recent report by BloombergNEF found that solar and wind energy accounted for 10 percent of global electricity generation in 2021. Just 10 years ago, the two sources combined for less than one percent of global generation. —Who knows how far we’ll be looking back at 10 percent a decade from now?

- After Hurricane Ian battered the Caribbean and Florida, solar energy proved to be one of the most resilient and important sources of power for many residents in the aftermath of the storm. Particularly in Puerto Rico, where much of the electric infrastructure was brought offline, rooftop solar provided many residents with a lifeline to power.

- Last week, the U.S. Treasury began holding meetings with leaders in the clean energy industry in an effort to streamline new guidance on incentives included in the Inflation Reduction Act. The meetings, which will consist of six roundtable discussions, are focused on expediting the development of guidance while ensuring it is “correct and strikes the right balance”.

- September saw the return of the industry’s largest trade show, RE+ (formerly named Solar Power International), which saw more than 27,000 attendees descend on Anaheim for the conference. This was the first show to include all technologies in the clean energy space and the excitement around the Inflation Reduction Act from the industry at large was evident. For our analysis of the Inflation Reduction Act, read our lead article from the August edition of the Sol SOURCE.

Recent Articles...

A Farm Less Ordinary: At the Intersection of Inclusion and Sustainability

Sol Systems Sets the Standard: Beyond Carbon Neutral in 2023

The Sol SOURCE – August 2022

The Sol SOURCE – August 2022

Click here to read the full August edition of the Sol SOURCE.

The Sol SOURCE is a renewables journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains trends and observations gained through interviews with our team, incorporating news from a variety of industry resources.

Below, we have included excerpts from the August 2022 edition. To receive future Journals, please subscribe or email SOURCE@solsystems.com.

STATE MARKETS

California – Property tax exclusion likely extended to 2026

On August 23, 2022, SB 1340, a bill to extend the property tax exclusion for solar to 2026, went to the Governor. California has seen several reversals of long-planned energy policy decisions this year, including efforts to keep its last nuclear plant open while shelving (for now) plans to recalculate net-energy metering (“NEM”). The California Public Utilities Commission (“CPUC”) recently issued a proposed decision that would delay a NEM 3.0 program to August 27, 2023.

On August 25, 2022, the California Air Resources Board will vote on regulation that will ban sales of new gas-powered cars by 2035. The measure is expected to pass.

Delaware and New Jersey – Third Circuit Court rules on Delaware and Hoboken climate lawsuits

On August 17, 2022, the Third Circuit Court agreed that lawsuits brought by the State of Delaware and the City of Hoboken, New Jersey, against oil companies belong in state courts. This is the latest in series of cases fossil fuel companies have sought to hear in federal courts, which are presumed more hostile to states’ efforts to hold major fossil emitters accountable for climate change. Four other appellate courts that have already rejected these efforts, but oil companies have asked the U.S. Supreme Court to rule on the issue.

District of Columbia – RPS increase legislation introduced

Before leaving for recess, Councilmember Cheh introduced the Local Solar Expansion Amendment Act of 2022, which would maintain the Solar Alternative Compliance Payment (“SACP”) at $500/MWh and raise the solar carve-out from 10 percent to 15 percent by 2041 (DC already requires 100 percent renewables by 2032). The bill will be heard on October 3, 2022.

As a reminder, effective April 1, 2022, all new systems must have a revenue-grade production meter or inverter-based production measurement equipment. Older systems may continue to use estimation.

Mayor Bowser signed two pieces of legislation into law on August 1, 2022:

- The Clean Energy DC Building Code Act requires that all new buildings be net-zero by 2026 and energy produced onsite must be from renewable sources.

- The Climate Commitment Act requires that the District achieve carbon neutrality by 2045. To ensure that the target is met, the law sets five-year greenhouse gas targets. In addition, the law mandates fossil fuel-powered space or water heating appliances may not be installed in government buildings after January 1, 2025. Starting in 2026, the DC government may only purchase zero-emissions vehicles.

There remains no official word on nominees for the DC Public Service Commission vacancy.

Illinois – Illinois Power Agency submits final plan to the Illinois Commerce Commission

Illinois continues working to implement myriad regulatory requirements stemming from last year’s landmark Clean Energy and Jobs Act (“CEJA”). After revising the Long-Term Renewable Resources Procurement Plan (“LTRRPP”) based on stakeholder feedback, the Illinois Power Agency submitted its final plan to the Illinois Commerce Commission (“ICC”) on March 21, 2022. The ICC issued its final order on the LTRRPP on July 14, 2022 which serves as a guidebook for CEJA’s implementation and application. Shortly after, the IPA filed their compliance plan containing REC pricing for Block 6, which is set to open on September 1, 2022. Additional details on the LTRRPP along with the full REC model and prices can be found in this IPA announcement. The IPA is also expected to circulate an updated guidebook prior to the opening of Block 6.

The ICC also approved two additional procurement events to be held this fall and next summer for RECs from utility-scale wind, utility-scale solar, and brownfield site photovoltaic projects. The fall procurement is expected to be posted on October 7, 2022 with bids due by December 9, 2022.

Maine – Governor’s Energy Office reconvenes DG Stakeholder Group

Maine continues to work to incent a wider variety of clean electricity options in the state while wrestling with their role in the national transmission system. The Governor’s Energy Office has reconvened the distributed generation stakeholder group now that Maine’s legislative session has ended. We expect a straw proposal later this fall to contain more successor program design details in advance of a final report due January 2023. Litigation continues over the fate of the New England Clean Energy Connect (NECEC) transmission project, which was the subject of a ballot measure approved by state voters in November. The NECEC project would carry electricity from Canadian hydropower to the New England grid.

Massachusetts – Omnibus climate legislation signed into law

The Baker Administration continues to push forward several energy-related items in its last year. On April 15, 2022, the Massachusetts Department of Environmental Protection (“MassDEP”) published proposed amendments to the Clean Energy Standard (“CES”). The proposed amendments include setting the CES alternative compliance payment (“ACP”) and Clean Energy Standard-Existing (“CES-E”) ACP to $35/MWh and $10/MWh respectively for years 2022 through 2050. Comments were due on June 3, 2022, and we expect a final decision in the coming months.

On August 11, 2022, Governor Baker signed omnibus energy legislation into law (HB 5060). Among other things, the law maintains an offshore wind procurement target of 5,600 MW by 2027 and creates an offshore wind tax credit. The law also addresses grid modernization and directs the Massachusetts Department of Energy Resources (“DOER”) to study a variety of energy storage programs. Furthermore, it requires that DOER include a pollinator-friendly solar incentive in the Solar Massachusetts Renewable Target (“SMART”) program or successor program, bans biomass from qualifying for the RPS after January 1, 2022, as an eligible RPS Class I or II technology, and mandates that all new vehicle sales in the state be zero-emission beginning in 2035.

New Jersey – Senator Smith introduces RPS revision bill

The Board of Public Utilities (“BPU”) continues to broadly deny extensions for projects unlikely to meet Transition Renewable Energy Credit (“TREC”) deadlines while smoothing the process of moving projects from the TREC to the Administratively Determined Incentive (“ADI”) successor program. On April 26, 2022, BPU issued a Straw Proposal for the Competitive Solar Incentive (“CSI”). While there have been delays, the CSI program is expected to launch later this year. The BPU is also expected to review ADI incentive levels as part of the one-year review. Legislation related to interconnection (S431), energy storage incentives (S2185), remote net metering (S2848), and the legacy SREC program (S439) moved through the Senate and are expected to be heard in the Assembly this fall.

Senator Smith (D-17) recently introduced S2978, which would revise the RPS in New Jersey. Specifically, the bill would apply the Class I standard to electricity sold in the State after subtracting electricity generated by existing nuclear and other zero-carbon sources. In addition, the bill would also require that at least 50 percent of RECs used to comply with the RPS be located in New Jersey. Finally, it would mandate that 100 percent of retail electricity delivered to New Jersey be from Class I sources by 2045 and would remove the Class II requirement in 2045. The bill has been referred to Senate Environment and Energy Committee, where we expect a hearing this fall.

New York – New York Power Authority opposes Assembly’s Build Public Renewables Act

On July 28, 2022, the New York Power Authority (“NYPA”) announced that they did not support the Build Public Renewables Act that passed through the Senate (S6453) on June 1, 2022. The Assembly companion bill (A1466) did not move forward prior to the end of session. The bill would have directed NYPA to build and own new renewables and require the Authority to largely shut down fossil fuel plants by 2030. New York State has a goal to reach 70 percent renewable electricity by 2030.

Ohio – Public Siting Board proposes procedure revisions

On June 16, 2022, the Ohio Public Siting Board proposed procedure revisions, including one that would require solar setbacks of 150 feet from roads and unaffiliated properties and 300 feet from unaffiliated residences. Other proposals include public disclosure requirements for new facilities, codifying decommissioning requirements included in SB 52, and fencing requirements for solar sites. Comments were due August 12, 2022.

Pennsylvania – Court-issued injunction delays Pennsylvania participation in RGGI

After several showdowns between Governor Wolf (D) and the Republican-controlled Legislature, including a last-minute stay on publication, regulations establishing Pennsylvania’s participation in the Regional Greenhouse Gas Initiative (“RGGI”) were published April 23, 2022. However, on July 8, 2022 the Commonwealth Court issued an injunction, further delaying Pennsylvania’s participation. The injunction required plaintiffs to post a $100 million bond, subject to forfeit if they lose the underlying challenge to RGGI.

Virginia – A Stakeholder Consultation Regulatory Advisory Panel (RAP) was recently convened to make recommendations to the Virginia Department of Environmental Quality (“DEQ”) and the legislature regarding implementation of HB206, which modifies the Permit By Rule process for solar projects under 150 MW. Topics covered across the five RAP working groups include avoidance & mitigation, mitigation/in lieu, significant adverse impact for projects less than 10 acres, and local control.

In March 2022, DEQ announced that it would define solar panels as impervious surface areas. On April 14, 2022, DEQ released additional guidance that pushed implementation out to January 1, 2025, for all projects that have not received interconnection approval. In July, DEQ released two additional stormwater guidance documents focused on stormwater management and erosion and sediment control. Comments are due August 31, 2022.

The 2022 Virginia Energy Plan process has officially kicked off (as directed by the Virginia General Assembly, every four years the Virginia Department of Energy develops a comprehensive Virginia Energy Plan). The 2022 Energy Plan will provide energy policy recommendations around environmental goals, energy costs, consumer choice, and innovation.

On April 14, 2022, the Virginia State Corporation Commission (“SCC”) opened a docket to establish a self-certification process for small distributed generation systems seeking to qualify as low-income projects and consider additional GATS-related questions. On July 26, 2022, the SCC issued an order for additional comments in the docket. Staff are required to file comments by September 22, 2022. All other stakeholders may submit comments until October 20, 2022. One issue the industry has raised is the September 2021 Order requiring revenue-grade meters for all projects regardless of size or interconnection date.

SOLAR CHATTER

- The U.S. Energy Information Administration (EIA) announced that renewables will make up 22 percent of electricity generation in the United States in 2022 This number is expected to rise to 24 percent in 2023 as renewables continues to carve out a larger portion of the total American electricity grid.

- Solar continues to show its strength in creating American manufacturing jobs, as the famed Pittsburgh Bethlehem Steel Plant has now been reopened to manufacture solar tracking systems. The factory, commissioned by Nextracker, is the third they’ve commissioned with a steel manufacturing partner this year.

- Electric vehicles reached a critical adoption benchmark in the United States in June, as five percent of new car sales were fully electric. Financial analysts see reaching five percent as the breakout from the early-adopters phase, where the technology begins to become more mainstream and adoption begins rapidly accelerating. As adoption continues, car manufacturers begin a more rapid shift in supply, and through an accelerated learning curve and economies of scale, prices can fall quickly. We expect the incentives in the IRA will ensure this growth happens in North America, further growing domestic clean energy manufacturing capabilities.

- Registrations opened for the U.S. Department of Energy’s 2023 Solar Decathlon Design Challenge, where college students across the world compete to design sustainable buildings powered by renewable energy. Sol Systems has multiple Decathlon alumni, with Robertson’s having taken second place in in the inaugural competition for the University of Virginia.

- Omaha Public Power District (OPPD), the public utility responsible for electricity in and around Omaha, Nebraska, voted unanimously to delay the closure of its coal plant by three years, the sixth such delay to occur in 2022 alone. OPPD’s reasoning mirrors similar decisions recently that citied tariffs and other supply chain constraints as well as interconnection delays in delaying closure of coal plants in favor of clean electricity like solar. These decisions will have myriad environmental and public health implications for local communities as well as globally.

- SEIA recently released a Manufacturing Roadmap, laying a path for the U.S. manufacturing industry to thrive in the wake of the the Inflation Reduction Act’s (IRA) investments in reshoring and growing domestic manufacturing. SEIA shows how the U.S. can exceed 50 GW of domestic solar manufacturing capacity by 2030. A key element of this is the development of a well-trained workforce that brings new entrants into the clean energy space and helps current energy workers transition.