The solar industry hates stasis, which is exemplified in industry members’ self-proclaimed rides on “the Solar Coaster.” Solar trade shows and conferences are filled with companies looking to provide solar with its “next big thing.” One of solar energy’s (literal) shiny new objects - bifacial modules - has been a hot topic at these conferences and in news articles for a few years now. Until recently, most of the potential benefits of bifacial modules have remained…potential. However, bifacial modules are starting to transition from theory into reality, as more projects around the world and in the United States specify bifacial modules, reach financing and construction, and begin operation.

We get it. You probably think you’ve read this story before. You’re expecting another article about the existence of bifacial modules (with accompanying diagrams), reviewing how there’s some benefit of the technology while expressing a decent amount of uncertainty, and a conclusion of “I guess we’ll wait and see what happens with this promising new technology!”

We’ll be sure to cover all those standard bases; don’t worry. But this time, we’ll also dig into the wonky details of how implementing this technology impacts a real structured finance model, how a debt provider’s confidence in that energy benefit affects returns, and what you really need out of your bifacial project to generate positive returns. It’s time to grab your bifocals and look at (both of) the bright sides.

Introduction to the Technology

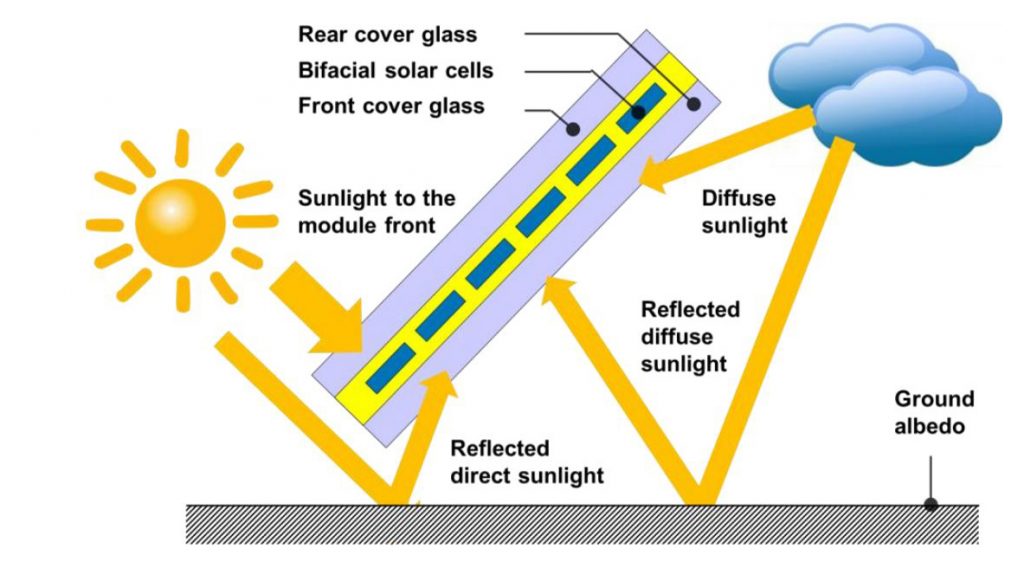

Bifacial solar photovoltaic modules produce energy on both sides of the module. Energy is captured on the back of the module by collecting sunlight on its backside that was reflected off the ground.

[caption id="attachment_7416" align="aligncenter" width="600"] Diagram of a bifacial module (Source: TUV Rheinland Enerqv)[/caption]

Diagram of a bifacial module (Source: TUV Rheinland Enerqv)[/caption]

There’s minimal doubt that there will be some benefit to project performance due to energy from the backside of the module (known as bifacial gain), but the question remains: exactly how much?

While a relatively standardized process for energy modeling has been developed and accepted for monofacial systems, this has not yet happened for bifacial systems. The main roadblock to standardization has been that their implementation greatly increases the importance of a few variables that have a negligible effect on monofacial systems and are thus less well studied, such as albedo (the measure of ground reflectance), and the shading and mismatch created by the racking structure underneath the modules. While a number of field test sites have been installed in the last few months, operational data from those projects to support better energy modeling practices is months away.

Few analyses have looked at how this uncertainty impacts the actual financing of a project. The increase in cost, energy generation, and uncertainty on that energy generation, will affect all three of the main parties in a structured transaction: sponsor equity, debt, and tax equity. We’ll examine these impacts first in a general sense, and then through the lens of a real project.

The Juicy Model Details

We’ll examine an existing development project with monofacial modules, then assume the substitution of bifacial modules of an equivalent frontside power rating while holding all other project variables constant. We then assume a market-based module cost increase for a project in 2020, as well as an “EPC Adder” taking into account second-order impacts of adding bifacial modules:

When modeling, we used an inverted lease structure with project-level debt, one of several commonly used financing mechanisms for structured solar transactions.

When modeling, we used an inverted lease structure with project-level debt, one of several commonly used financing mechanisms for structured solar transactions.

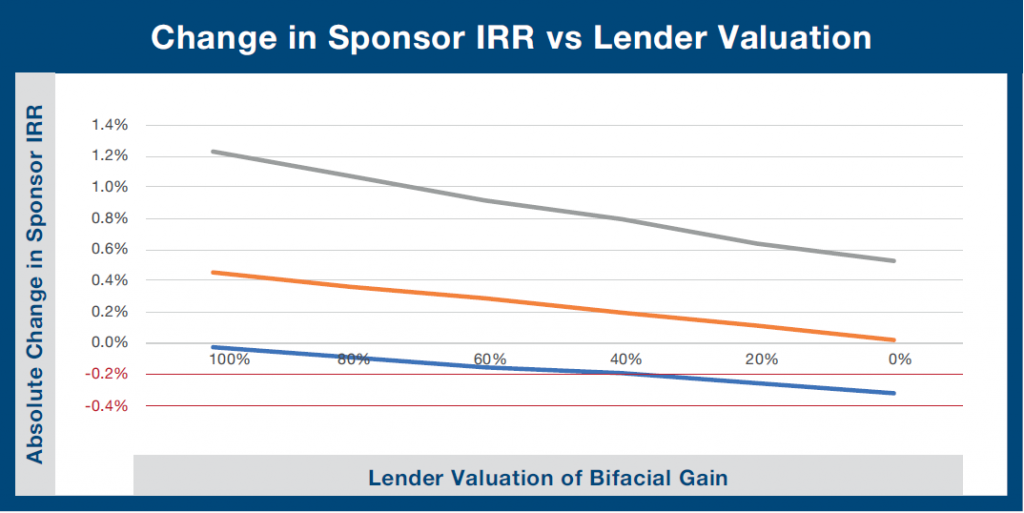

All else being equal, the more debt a project can support, the better the returns because debt is generally the “least expensive” source of capital for a project. Lenders tend to be a risk-averse bunch, but if a lender will value more of the increase in energy yield, this will increase the amount of debt the project can raise. However, debt providers we spoke with suggested they might only value a portion of the modeled bifacial gain given the increased uncertainty and the current lack of available bifacial project performance data.

This means that if a project had a modeled bifacial gain of 8% over an equivalent monofacial project, all else being equal, a lender valuing 100% of that gain could be expected to provide 8% more debt than for the monofacial project. However, a lender valuing only 50% of that 8% gain may only provide an additional 4% more debt. This lender valuation variable is intended to illustrate the additional energy production uncertainty for bifacial projects. In order to make a project work, not only do you need enough modeled bifacial gain, that gain needs to be supported by sufficient certainty to be economically justified.

Show Me the Money

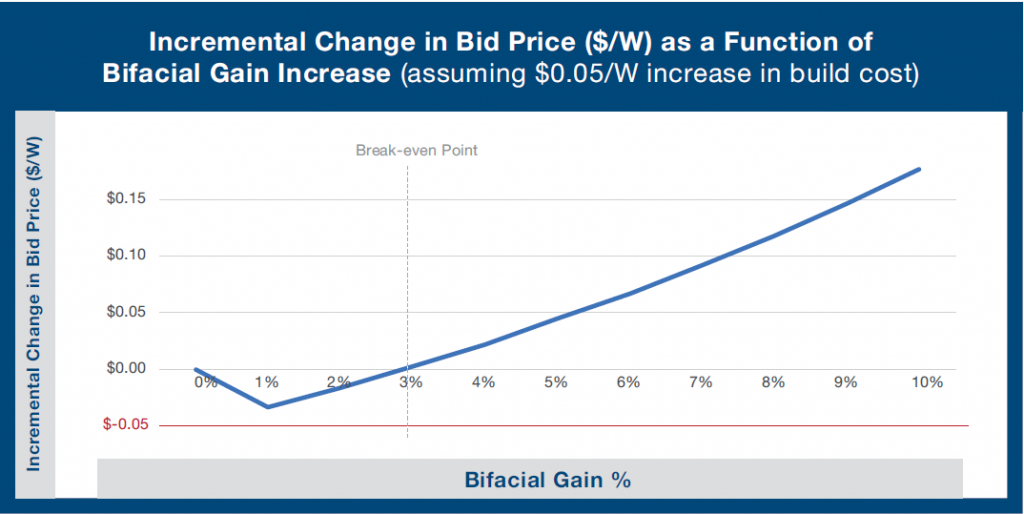

Our analysis suggests that for a fixed EPC cost increase of $0.05/W (roughly 5% on a typical utility-scale project that costs about $1.00/W to build), a bifacial gain of above 3-4% results in a more valuable project.

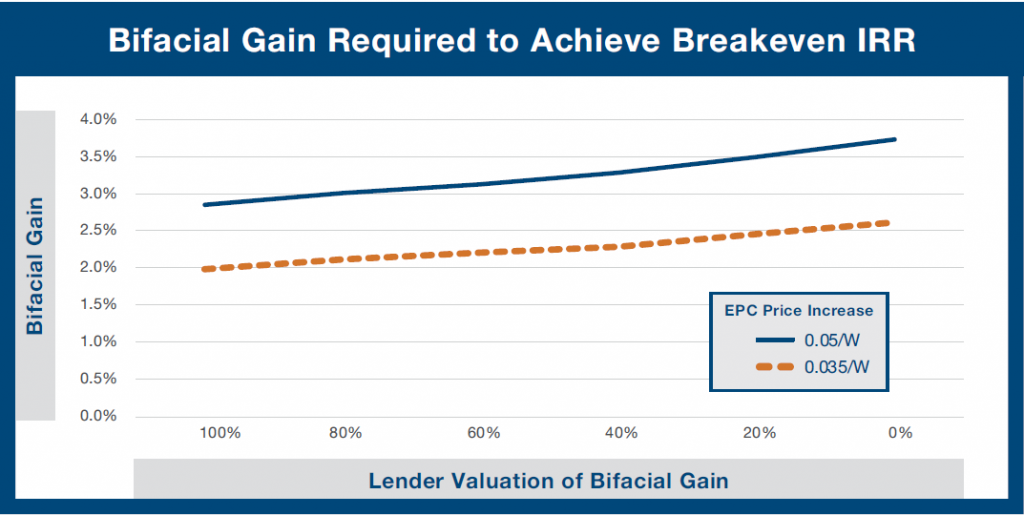

Remember – this is one project, and this analysis depends on some high-level assumptions, so these results will vary significantly project to project. However, the data still tells a compelling story. We calculated a baseline monofacial structured Sponsor IRR. We then ran the model incorporating the cost of adding bifacial modules, and a range of debt valuation of bifacial gain. The graph below shows the incremental increase in bifacial gain required for the project to “break even” by achieving our established benchmark IRR after incorporating bifacial modules. We show this at both our base assumption of a cost increase of $0.05/W, and at a more optimistic $0.035/W cost increase for comparison purposes.

Looking specifically at the case of 100% lender valuation of bifacial gain, anything above this breakeven point of around 3% caused a positive change in a theoretical project acquisition price. This means a bidder strategically valuing bifacial gain could offer a higher price and provide more value to project developers.

Looking at the more complicated case where we recognize the higher uncertainty of bifacial projects and potential variability of lender valuation of bifacial gain, the breakeven point can range from around 3% to nearly 4%.

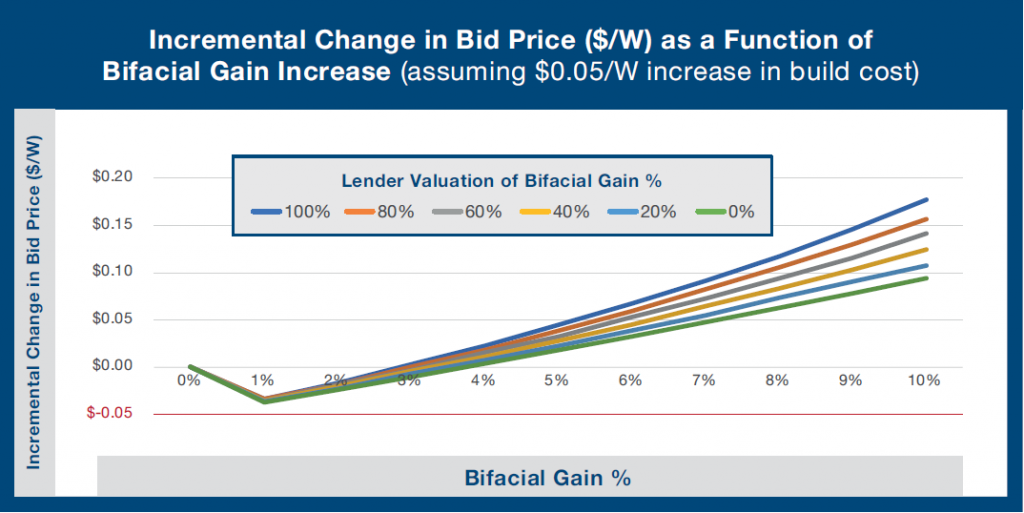

At a 5% bifacial gain, the value that a lender places on that gain can change the incremental project bid price by nearly $0.03/W. At a higher 10% bifacial gain, this change based on lender valuation leads to an even larger difference of about $0.08/W.

Looking at this another way, a bifacial project where the lender will value 100% of a 7% modeled bifacial gain is just as valuable as a project where the modeled bifacial gain is 10%, but a lender will not value that when sizing the project’s debt. This highlights the importance of combining technical accuracy with commercial practicality and the need to reduce uncertainty wherever possible.

For buyers in a market with abundant capital chasing a finite supply of projects, any increase in project debt and subsequent reduction in cost of capital creates a competitive advantage. For developers, there’s no need to overstate the importance of any additional cent of margin. This suggests that bifacial modules may no longer be a fancy “upgrade” for projects, but rather an important part of the industry’s competitive toolbox.

Let’s Get Real

So theoretical projects are great, but what people ultimately want is to know whether to hit “proceed to checkout” on that Amazon Prime bulk order of bifacial modules. What better way to do that than analyze whether it makes sense to incorporate bifacial modules on a real project that is currently in development. Watch the breakdown:

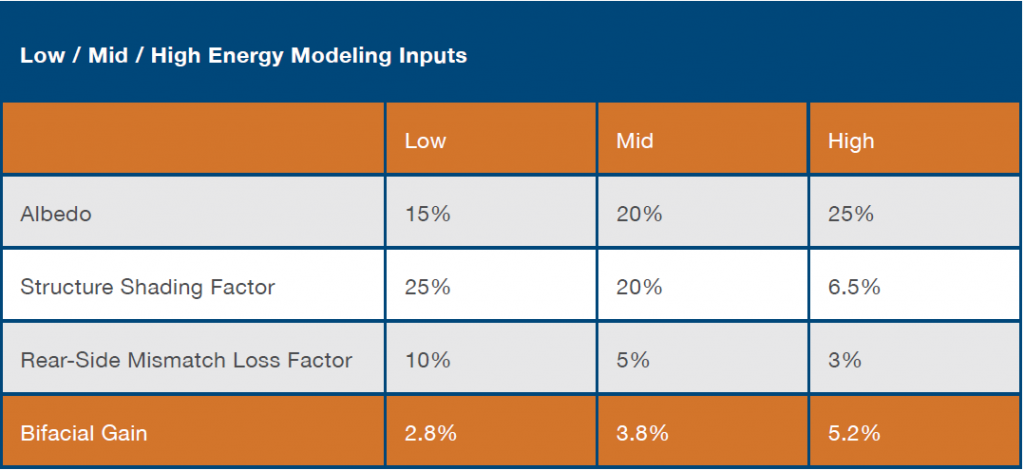

These energy modeling inputs were chosen to represent the full range of albedos for “grassy” sites, and the rear-side shading and mismatch factors were chosen to represent the widest range of loss assumptions we’ve seen in the market.

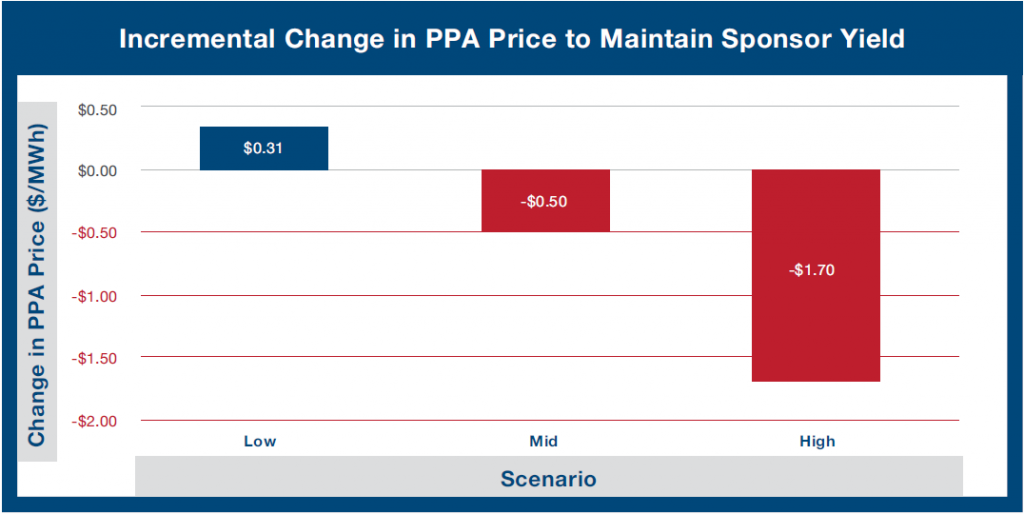

The graph below shows that for this particular project, even when lenders fully value the bifacial gain, the low case (2.8% energy yield increase) does not support the increased costs of going bifacial. However, the mid and high cases begin to present an argument for implementing the technology so long as lenders aren’t overly punitive in their valuation of the projected energy yield increase.

As a note on this particular project: this site was not optimized from the beginning with bifacial modules in mind. In fact, as a project in a particularly low-albedo region (~16%), with tight row spacing of a 42% ground coverage ratio, and a high DC:AC ratio of 1.41, this is exactly the type of project and design with which bifacial modules are not supposed to be valuable. Even so, the mid case for energy yield increase leads to a small, but positive, increase in sponsor returns, no matter what valuation is applied to that bifacial gain by the lender. If this project and its design was optimized with bifacial modules in mind from the start, we’d almost certainly see higher returns.

What about PPA prices?

Indeed. Looking at this from the flip side (pun intended), this could also translate into a developer’s ability to offer a lower PPA price to an offtaker while still maintaining benchmark economics. Using the same low, mid, high methodology, we analyzed the incremental change in PPA price that would support our base case monofacial sponsor return. In the low bifacial gain scenario, the project required a higher PPA price to maintain economics given increased cost and minimal lender valuation of the bifacial gain. In contrast, once we move to the mid and high scenarios, we can reduce the PPA price and still maintain economics. From what we’re seeing in the industry, this is already happening, especially on the larger utility-scale side. Bring on the bifacial RFPs.

Wrapping It Up

There’s real value to be gained from this technology, but we may have a chicken and egg problem. Recognizing the value of this technology is contingent on multiple parties properly valuing bifacial gain, including lenders. However, lenders may be resistant to doing so until better market data exists, and developers may hesitate to implement the technology until they can calculate tangible benefits through increased sale prices or sponsor returns.

Based on this analysis, even for a site and design that has not been optimized with bifacial modules from the start, a very small increase in energy yield can support the additional equipment and installation costs. While it wasn’t necessarily a slam dunk on this particular project, what we take away from this is that bifacial modules should be a part of your evaluation and optimization process for every project.

So get out there and talk to your friendly neighborhood independent engineer. Collect test site data. Work with buyers (like Helios) who know how to assess the value of this technology. There’s yield to be had, and the grass may in fact be greener on the other side of the module.

Becca Glazer is a Director on Sol Systems’ structured finance team, in which she structures tax-motivated partnership investments for Sol Systems’ corporate and institutional clients. Kevin Mayer is a Development Engineering Manager on Sol Systems’ customer solutions team focusing on the design, energy modeling, and financing of Sol Systems’ projects in development.

This is an excerpt from the Q1 2019 edition of The SOL SOURCE, a quarterly electronic newsletter analyzing the latest trends in renewable energy development and investment based on our unique position in the solar industry. To receive future editions of the journal, please subscribe.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last ten years, Sol Systems has delivered 800 MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com