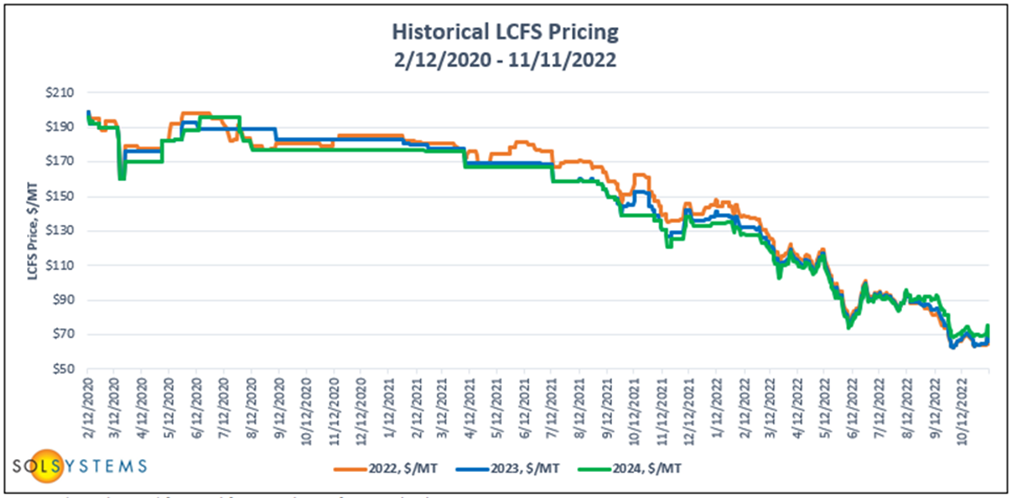

LCFS credit prices in California continue to plummet as supply outpaces demand. Current spot prices for immediate delivery are in the low to mid $60s, a ~30 percent drop from prices last quarter.

Similar to past quarters when the California Air Resources Board (“CARB”) held stakeholder convenings, the market did see a slight uptick on pricing following CARB’s November 9, 2022 meeting when pricing was around the $63-69 range. However, the uptick was short lived.

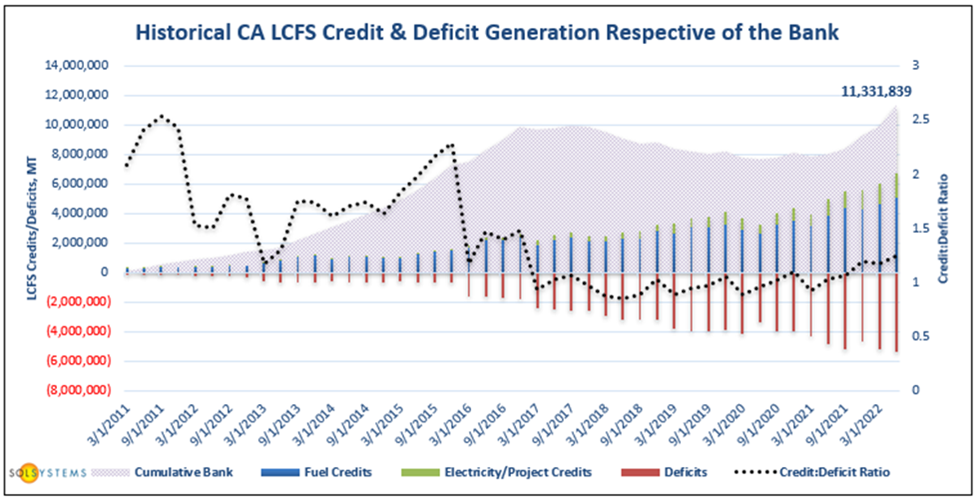

CARB’s Q2 2022 data posted on October 31, 2022 shows an all-time high of credits outpacing deficits with a surplus of 1.35 million metric tons of credits generated in Q2. The credit bank now sits at 11.3 million metric ton credits.

The downward spiral of LCFS pricing over the past year has impacted many stakeholders’ infrastructure development plans as well as LCFS credit monetization strategies. With regards to project buildout, developers and investors have been taking a more cautious approach, either delaying or halting projects altogether. For LCFS monetization, many market participants, particularly those in the electricity pathway, are re-thinking the cost-benefit analysis of utilizing renewable energy credits (“RECs”) to lower carbon intensity (“CI”) scores. In the past, there has been no question of whether purchasing RECs was worth it as the delta between REC purchase costs and LCFS revenue was large enough to make the REC investment pay for itself in multiples (i.e. despite the added REC procurement costs, market participants would generate enough additional LCFS credits from the purchase to come out ahead). As the delta shrinks, purchasing RECs may no longer be worth it. Where that threshold is will differ from participant to participant based on the vehicle type utilized, the energy economy ratio, and other factors. Sol Systems can work with clients to answer any REC related questions and determine what the optimal REC procurement strategy may be. This market dynamic may also put a downward pressure on REC pricing in CA.

This analysis was featured in the November 2022 edition of the Sol Standard, a quarterly newsletter that provides up-to-date pricing data, market analysis, and policy trends to keep clients up to speed on the country’s growing low carbon and clean fuels programs. To subscribe and access past editions of the The Sol Standard, fill out our subscribe form here.