This article was co-authored by Andrew Grin and Kevin Mayer.

This is an excerpt from the November 2017 edition of The SOL SOURCE, a monthly electronic newsletter analyzing the latest trends in renewable energy based on our unique position in the solar financing space. To receive future editions of the journal, please subscribe.

Like a sunflower subtly rising and falling with the sun, tracking technology has the power to gently rotate solar panels, boosting a solar project's production and economics without the need for solar cell breakthroughs. Throughout the last 10 years, racking manufacturers have worked to refine tracking technology and have moved from niche pilot projects to bankable products with serious advantages in almost all U.S. markets. Even though the technology has gained acceptance within the investment community, with the rapid change in popularity in the past few years, Sol Systems commonly receives questions on the technology from those looking to understand the benefits of tracking systems. Every developer, EPC, and offtaker should be taking a hard look at trackers as a first step in ground-mount project analysis (if they are not already).

Tracking Tech

[caption id="attachment_5433" align="alignright" width="300"] A Sol Systems developed single-axis tracking system in Lexington, NE[/caption]

A Sol Systems developed single-axis tracking system in Lexington, NE[/caption]

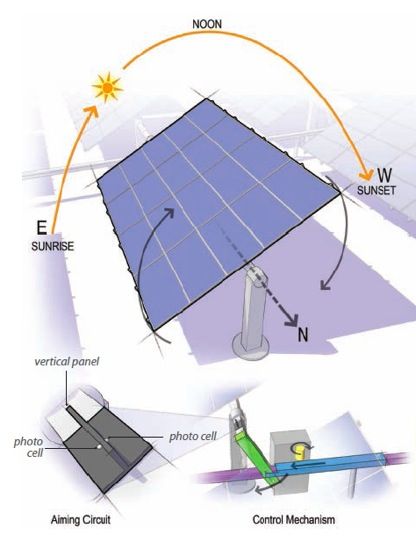

While solar trackers have the power to increase yields by 10-20%, not all trackers are made the same. Tracking technology can take many forms, from horizontal single-axis to vertical, tilted, and a multitude of dual axis trackers. One variety of tracker has begun to dominate the market. Today, the gold standard for bankable trackers are horizontal single axis trackers that use a small number of simple, reliable motors programmed to slowly follow the sun.

These tracking systems work by rotating solar modules on a horizontal tube from east to west – more directly facing the sun as the sun rises and sets. Depending on the location, trackers can increase annual energy production by 8-20%, with the highest benefit coming in clear, dry climates, and lower but still significant benefits in cloudier climates.

[caption id="attachment_5432" align="aligncenter" width="416"] Diagram of a horizontal single-axis tracker. Source[/caption]

Diagram of a horizontal single-axis tracker. Source[/caption]

The motion of the PV modules is typically controlled by electric motors throughout the array. The two main architectures available are 1) a small number of larger, centralized motors controlling up to 28 rows at once through a drive shaft, or 2) a decentralized architecture with smaller, self-powered motors controlling each row independently. Each architecture has its advantages, notably in differences in site design flexibility, but both have proven their reliability across gigawatts of operating installations around the world.

Backing Solar Tracking

The basic economic evaluation of solar trackers and any new solar technology has always been at the intersection of comparing performance benefits (higher power production), costs (new tech is typically more expensive to start), and bankability (the ability to get financing for this new tech). As trackers have become more prevalent, the operational “road miles” have generated a huge data set to support long-term viability, and have found that tracking projects can expect tracking component availability of greater than 99.9%.

By the end of 2015, according to the Energy Information Administration (EIA), we saw a significant data point demonstrating that more than half of all operating utility scale projects in the U.S. used tracking technology. That number is set to grow even further, as according to GTM Research "over 70 percent of U.S. ground-mount projects are now being installed with trackers.” While the EIA notes that most of these tracking projects are in the western U.S. (due to greater land availability and better production benefits), tracking costs have decreased to the point where Sol Systems expects to see a continued rise across the country, including on the East Coast. In just one example of a relatively small East Coast project utilizing trackers, Sol Systems is currently co-developing and financing a 6MWAC project with a municipal utility in Danville Virginia, currently under construction.

Developers, utilities, and offtakers who haven’t considered the benefits of trackers are missing out. It’s now clear that in most of the U.S., the additional benefits are worth the upfront cost, and that investors are willing to bank these costs.

Grid Benefits

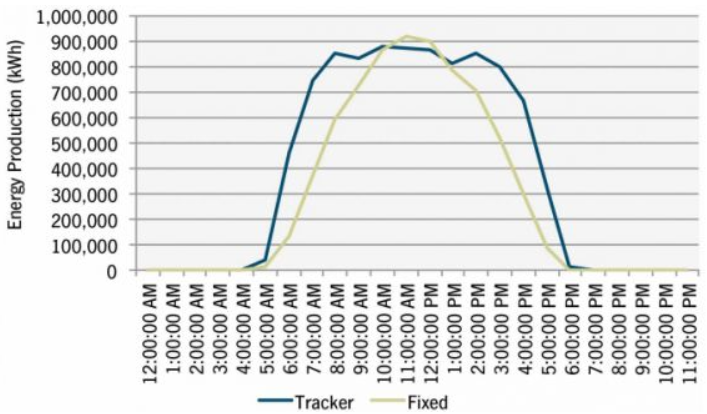

In addition to the increased energy production expected with tracking systems, they also produce more energy later in the afternoon than a south-facing fixed tilt system. An example of a typical day in Phoenix, Arizona is shown below.

[caption id="attachment_5437" align="aligncenter" width="500"] Caption: Energy Production Comparison, Fixed-Tilt vs. Single-Axis Tracking. Source[/caption]

Caption: Energy Production Comparison, Fixed-Tilt vs. Single-Axis Tracking. Source[/caption]

In general, the peak customer demand for utilities is in the late afternoon, especially during the summer, so tracking systems can widen the production curve relative to a south-facing fixed tilt system. In particular, for utilities that purchase their energy from wholesale electricity markets, in addition to providing the lowest levelized cost of energy (LCOE), tracking systems can maximize production when energy is most expensive during peak demand. This price incentive is so strong that some utilities have built west-facing fixed-tilt systems, trading off total production for ideally-timed peak production. With tracking systems no such compromise is needed, and utilities can secure both volume and optimization.

-

The cost of building a tracking system currently only increases upfront project costs by approximately 11%, and with the tracking components expected to decrease 5 to 7 percent per year, the increased yield and peak generation benefits look more attractive by the day.

Shameless plug: Have a project you are evaluating between tracking and fixed tilt? Reach out to our investments team who would be happy to take a look at finance@solsystems.com.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered 650MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.