The SOL SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the January 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

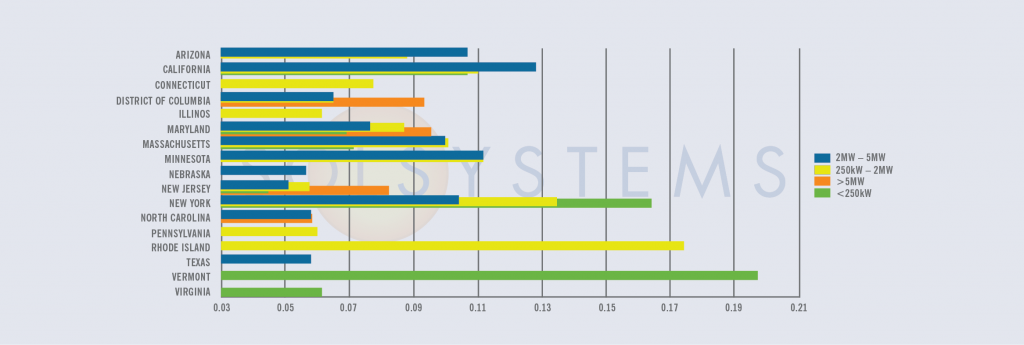

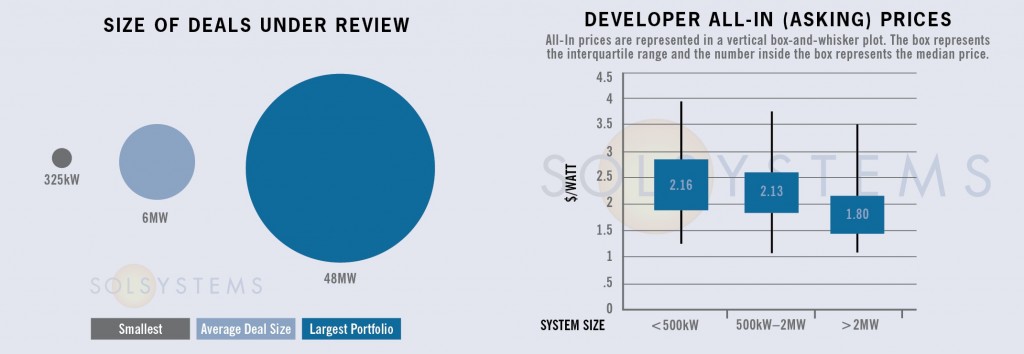

PROJECT FINANCE STATISTICS

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

Have a solar project in need of financing? Our team can provide a pricing quote for you here.

STATE MARKETS

Ohio – On December 27, Ohio Governor John Kasich affirmed his support for renewable energy jobs and vetoed House Bill (HB) 554. The legislation that would have eviscerated the state’s renewable portfolio standard (RPS) by making the standard voluntary for two years. A voluntary standard would have removed the “teeth” from the RPS, sending a signal that Ohio was not open to renewable energy business. In a statement on the veto, Governor Kasich stated that HB 554 would have created “self-inflicted” damage to the state’s economic competitiveness. As a result of the veto, the RPS, which was on pause in 2015 & 2016, resumed on January 1.

While rhetoric from RPS opponents has cited high costs of the program, publicly available data from the Public Utilities Commission of Ohio (PUCO) shows that the RPS costs ratepayers an average of 29 cents per month, a small price to pay for over 4,800 in-state jobs.

Governor Kasich was the third Midwestern Republican governor to support local renewable energy investment this past December. Illinois Governor Rauner signed a massive RPS bill in early December, and Michigan Governor Rick Snyder signed a modest increase to the state’s RPS shortly thereafter.

Maryland – All eyes are on Annapolis as the local solar industry awaits a veto override as early as next week. In May, Governor Hogan vetoed House Bill (HB) 1106, legislation that would have increased the state’s renewable portfolio standard (RPS) to 25% and slightly increased the state’s solar carve-out. While the solar carve-out increase is modest, it will be an important first step in providing relief to the local solar renewable energy credit (SREC) market, which has plummeted in value over the last year given larger than expected residential builds, and to a lesser extent, the perception of a large PJM interconnection queue. Maryland SRECs are currently trading at $18, only slightly higher than Pennsylvania and Ohio, two markets that have experienced lackluster solar growth over the last several years.

Meanwhile, after much delay, the 300MW+ community solar program will soon open for business. Stay tuned!

Virginia – The Solar Energy Industries Association (SEIA) estimates that solar in Virginia grew by 72% over the last year. At Sol Systems, we predict even further growth in 2017, with the biggest gains coming from the utility-scale sector. Aside from Dominion’s 400MW by 2020 goal and some very high profile corporate offsite purchases, there is hope for success at the state house thanks to an intensive working group of solar industry and utility stakeholders. Notable legislation from the stakeholder group includes a utility-administered community solar program and a streamlined permitting process for utility-scale projects, as well as incentives for utilities to allow on-site power purchase agreements for large-scale projects. PPA legality has been limited to a string of other bills has been introduced outside of the industry-utility coalition, and Ivy Main from the Sierra Club does an excellent write-up. With a large number of data centers existing in the state, which consume massive energy loads, the potential for major growth exists.

SOLAR CHATTER

- In the aftermath of last year’s IRS 50(d) ruling, we expect investors to coalesce around preferred tax equity structures and pricing, all while the prospect of corporate tax reform looms. Developers will most likely be pushed to bear this risk.

- While New Jersey’s “pull forward” legislation remains very much in play, some are optimistic about the chances of a longer term renewable portfolio standard (RPS) bill under a new administration; gubernatorial elections will take place this November. Notably, an aggressive 80% RPS bill has already passed the Senate. Meanwhile, New Jersey SREC prices have increased to $260 in anticipation of the BGS auction.

- Changes are on the horizon in New York. The Public Service Commission is expected to issue an order on the Value of Distributed Energy Resources (VDER) in the coming weeks. VDER is an ongoing proceeding to calculate the value of distributed generation to the grid and will ultimately replace net metering in the Empire State. Comments on the state’s 50% Clean Energy Standard – which will encourage large scale renewables – were due on January 10. While the 2017 procurement is expected to be much smaller than the industry had hoped, with the closure of Indian Point nuclear plant in 2021, large scale renewables could help to fill its gap.

- The solar industry is eagerly awaiting an updated proposal from the Massachusetts Department of Energy Resources (DOER) on the new solar incentive program, as well as word as to whether SREC II will be extended as a bridge to the new program. DOER will update stakeholders during a January 31 meeting. The Commonwealth is also in early stages in setting targets for energy storage and passed electric vehicle legislation at the end of last year.

- Changes to D.C.’s community solar regulations will grant residential community solar subscribers full retail credit. To be an eligible facility, projects must be located within the District of Columbia. While sites may be challenging to find, D.C. has the strongest SREC market in the U.S.

- The California Public Utilities Commission recently announced its revised proposed decision, creating guidelines for assessing time of use (TOU) rate shifts in pending investor owned utilities’ rate cases. Specific TOU periods and rate design will be determined separately in each IOU rate case. There is still hope among solar advocates that peak period shifts will be less severe than initial IOU proposals indicated. For commercial customers, systems will be eligible for 10 years of grandfathering under previous TOU period structures as long as initial interconnection applications are in by January 31, 2017 and final building permits are submitted by July 31, 2017 (December 31, 2017 for schools). Uncertainty persists around additional grandfathering for systems interconnected after July. On the storage side, the debut of the updated Self Generation Incentive Program (SGIP) continues to lag, with rumors of late signaling that Tier 1 of the incentive may not be made available until April.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 500MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.