The Sol SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the July 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

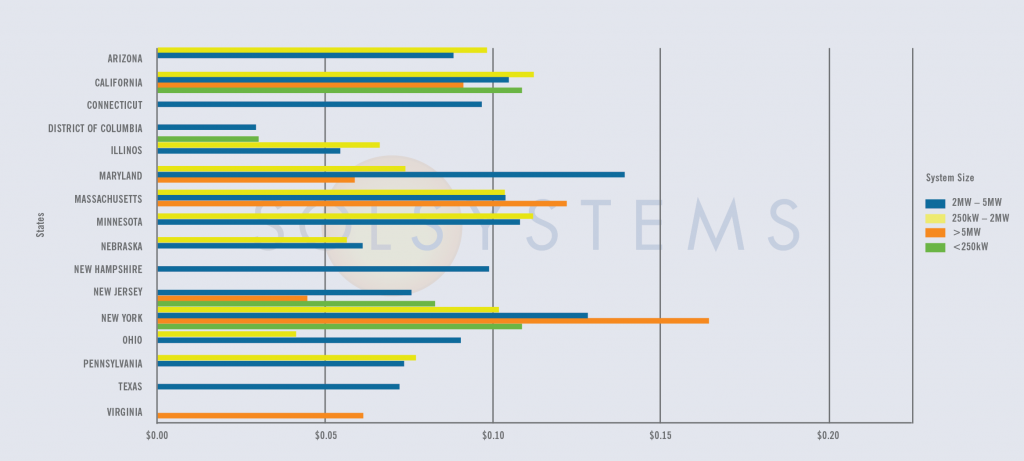

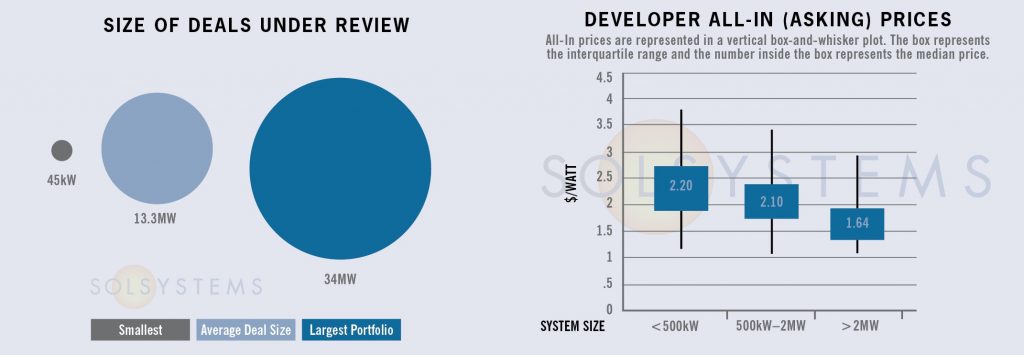

PROJECT FINANCE STATISTICS

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

Have a solar project in need of financing? Our team can provide a pricing quote for you here.

STATE MARKETS

Illinois: Illinois budget negotiations created a close call for the Renewable Energy Resources Fund (RERF), the funding mechanism for the state’s new low-income Solar for All and job training program. The Illinois solar community has a deep history of the legislature sweeping its fund, which is one of the problems that the Future Energy Jobs Act (FEJA), passed in December 2016 and enacted in June, looked to fix. While the utility-scale solar, community solar, and distributed generation adjustable block programs are no longer subject to state funding under FEJA, unfortunately, the low-income and workforce development training programs could be at the whim of Springfield. Thanks to the tireless efforts of the local solar community and environmental advocates, approximately $96M in funds for these critical programs was preserved. Additionally, funding to the Illinois Power Agency, the regulatory body charged with the very big task of implementing all of the state’s new solar programs, was preserved, and the lights will stay on at IPA so they can complete this critical work, hopefully in time for a mid-2018 launch.

Sol Systems is bullish on the Illinois solar market, which is poised to be the breakout market of 2018. And if you haven’t heard of the Environmental Law and Policy Center (ELPC) or the Little Village Environmental Justice Organization, the solar industry has them, among so many other local advocates, to thank for their contributions to FEJA and the upcoming renewable energy programs.

New Jersey: Substitute legislation has been introduced to S-2276, which was formerly known as the “pull forward” bill. Unlike the prior bill, which would have “pulled forward” New Jersey’s solar carve-out from 4.1% by 2028 to 4.1% by 2021, the carve-out is even more aggressive with a whopping 5.3% by 2021. Many solar industry veterans fear SREC prices are heading for a cliff, and increasing the RPS is a way to stabilize pricing and future growth prospects within the NJ solar industry. However, the most drastic change is that the carve-out will then begin to phase out as the incumbent solar renewable energy credit (SREC) market closes. The Board of Public Utilities (BPU) would close the SREC program by June 1, 2021, making way for a successor program, which could be either a Massachusetts style – SREC II, or a declining block incentive (DBI).

Remember: 2017 is an election year for New Jersey. Will S-2276 pass this fall and go to Governor Christie, or will the fate of the legislation lie with the new governor? And, if the new governor is Democratic candidate Phil Murphy, will he approve solar-only legislation, or want to wait for a new Energy Master Plan to tee up a potential 50% renewable portfolio standard (RPS), like New York’s, which could be a legacy issue for a new governor. Let’s also not forget that the utilities in the background have asked for nuclear subsides a la Illinois and New York style to keep their plants open over the coming years.

The second half of 2017 is poised to be an interesting year for New Jersey energy politics. Tune into the Sol SOURCE for updates.

Rhode Island: Look out, Massachusetts, small-but-mighty Rhode Island is positioning itself as a leader in clean energy deployment. After Governor Raimondo announced a 1GW clean energy by 2020 goal earlier this year, the state passed a suite of renewable energy legislation this session, including a 10-year extension to the RE Growth feed-in tariff program. RE Growth grants 40MW of contracts each year through a competitive bidding process. Results from the first enrollment of 2017 were announced recently, and the second enrollment will open shortly.

Developers in need of financing for Rhode Island projects or advice on bid strategy may contact our team at finance@solsystems.com. Customers interested in solar in Rhode Island may contact our Customer Energy Services team at energyservices@solsystems.com.

SOLAR CHATTER

- Could liquefied natural gas (LNG) exports and soon-to-be expedited pipeline and export terminal approval processes lead to an increase in natural gas prices? Perhaps so, and this increase in natural gas prices (and consequently electricity prices) could make solar even more cost competitive in the U.S.

- As equipment costs continue to fall, we could see solar moving toward commoditization sooner rather than later. As companies get closer to standardization on the fixed costs of the installation, and if module manufacturers all have the same commodity structure and similar prices, we could see a world of installation plus a nominal margin, with soft costs among companies being the biggest differentiator among firms.

- More counties in Virginia are catching up to Maryland and contemplating solar ordinances in their zoning regulations. The Maryland state permitting process is deferring more to local permitting processes, which is evidenced and formalized during the 2017 legislative session. Will Virginia follow? Hard to tell, but the local solar industry is committed to working with local interests on land use issues. The Maryland-D.C.-Delaware-Virginia Solar Energy Industries (MDV-SEIA) has made land use a priority. To plug into these efforts, contact leigh@mdvseia.org.

- The comment period for the Massachusetts SMART program has closed. While program development continues, uncertainty persists. Notably, we are concerned about the implementation of on-bill crediting provisions, as net metering caps have been hit for public and private projects in most territories. Without a NEM cap lift or proper on-bill crediting regime, development will slow.

- While the Suniva trade case looms, there are effects in the marketplace today. Developers are focused on closing deals and securing modules so that projects can be built in 2017. While uncertainty persists, many module manufacturers are inflating module prices for short term gain.

- The end of the year is quickly approaching and any projects that have end of year COD deadlines will need to have their financing lined up very quickly. Minnesota community solar garden (CSG) projects are a perfect example of this as many projects have an end of 2017/early 2018 construction completion deadline. Expect to see some projects come back on the market in the next month or so if they don’t have financing lined up or don’t have their subscribers fully booked.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 600MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.