The Sol SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the October 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

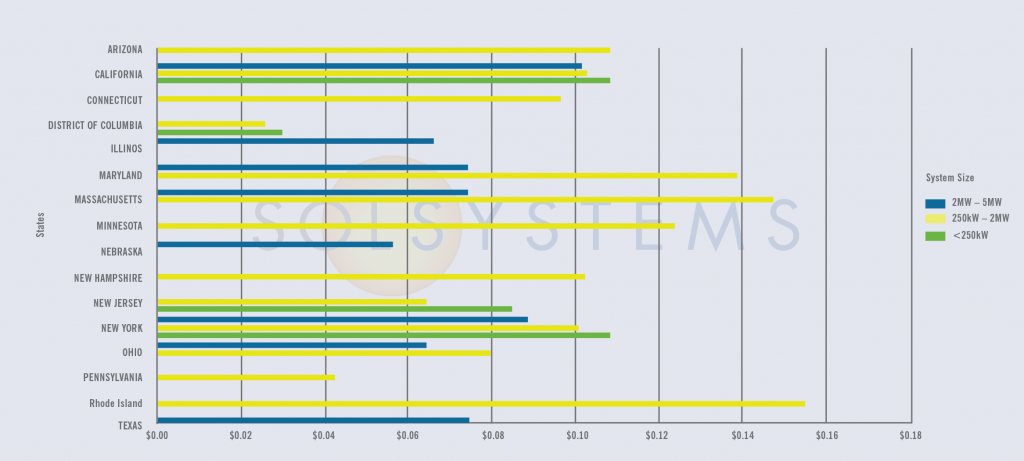

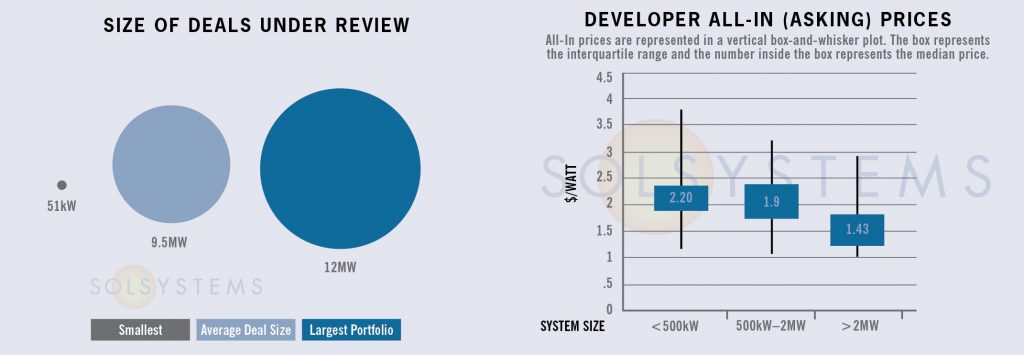

PROJECT FINANCE STATISTICS

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

Have a solar project in need of financing? Our team can provide a pricing quote for you here.

Connecticut – Bids for the Year 6 Fall LREC and ZREC procurement were due this week. With less funding available this round, pricing could prove to be quite competitive. Results will be announced in late November.

Meanwhile, public comments were due at the end of September on Connecticut’s Comprehensive Energy Strategy (CES), which provides a blueprint for future energy policy and programs in the state. For a refresher on the CES, check out the August issue of SOURCE.

Notably, conversation in the solar community on the CES has revolved around a more ambitious renewable portfolio standard (the CES calls for an increase in the RPS to 30%, while legislation this session was already calling for a 50% RPS), carefully crafted renewable energy tariffs that take into account lessons learned and best practices from other emerging tariff programs like Massachusetts SMART, and land use and siting for solar development, something that has been a hot button issue on much of the high density East Coast.

What does the future hold for solar in Connecticut? Stay tuned; if the Department of Energy and Environmental Protection (DEEP) sticks to its schedule, we should know in the coming days or November at the latest.

Illinois – All eyes have been on Illinois since the passage of the Future Energy Jobs Act (FEJA) in December 2016. FEJA will make Illinois a top market – and maybe even the fastest growing market - for renewable energy in 2018 and beyond. At long last, after months of technical sessions, careful due diligence from the Illinois Power Agency (IPA), and public input, we have a draft plan – and it’s looking good. In fact, we are so excited about Illinois that we have dedicated an entire article to it. Read more about it here.

Virginia – It’s election season for two major solar states: Virginia and New Jersey. In Virginia, solar has grown to over 3,200 jobs under Governor Terry McAuliffe. Will this growth continue under Virginia’s next governor? A high profile gubernatorial election will take place on November 7; many expect the Virginia race to provide a sneak peek into 2018.

The U.S. Solar Market Insight report estimates 260MW built to date in Virginia, and there are around 7GW in the queue holding on for a chance to sign a corporate PPA or bid into the next utility RFP. Negotiations remain ongoing within the Rubin Group for 2018 legislation that could serve as a relief valve, providing demand for all of this pent-up solar. In related news, Dominion released an RFP for 300MW of solar & wind; it doesn’t take much digging to deduce which data center customer will be the recipient of all of that renewable energy – remember Dominion’s IRP solar requirements are based on passing through estimated corporate demand, not yet rate-based generation.

In other Virginia news, FERC has approved the controversial Atlantic Coast pipeline, allowing the project to clear another regulatory hurdle.

SOLAR CHATTER

- American Electric Power (AEP) has released an RFP for 400MW of solar energy. This solar procurement has been years in the making following a settlement agreement which called for 900MW wind and solar. It’s been an energetic couple of years in energy politics in Ohio, where the Public Utilities Commission has offered new benefits to Amazon Web Services to bring new data centers to Ohio and has started its “PowerForward” initiative to advance the energy dialogue in the state and modernize Ohio’s grid. Meanwhile, Republican Governor Kasich has beat back attempts to repeal the state’s modest renewable energy laws while the legislature keeps fighting; chances are they’ll have to wait until Kasich is out of office to have a real shot. AEP’s 400MW would be significant in Ohio, where only 154MW have been installed to date, largely given the political uncertainty created by a past RPS repeal and subsequent attempts.

- We have noticed that potential customers think they need over-engineering rooftops in order to qualify for solar. This is a common misconception. As long as the structure is up to current code, it will most likely withstand the additional, and minimal, weight of solar.

- The value of distributed energy resources (VDER) ruling – New York’s new net metering alternate for commercial solar projects - continues to puzzle most solar developers. In response, NYSERDA has released a VDER calculator to help developers understand how to appropriately price projects for their potential customers, and help them understand how VDER works. The calculator is a very, very large Excel file and still very overwhelming, but we applaud the effort.

- And the projects and capital supply / demand imbalance continues... Investors are sometimes becoming increasingly flexible as the need to put money to work in a solar landscape plagued by a shortage of pipeline in this whirlwind year for the industry. We have seen investors become more flexible on smaller project opportunities and community solar, for example. In the tax equity world, the inverted lease structure is becoming less available, even though it offers developers additional benefits over partnership flips.

- The emerging Massachusetts SMART program is heating up among developers and customers alike. The Block 1 competitive procurement – which will inform the pricing for the 1600MW solar program – opened this week on 10/24. Results will be announced soon, helping to paint a clearer picture of project economics under the program.Given the policy goals in SMART around land use (and its general anti-greenfield development nature), the Department of Energy Resources has created a program which looks especially attractive to carports. Carports are an intelligent use of the built environment, but are cost prohibitive in many markets – but won’t be in Massachusetts.Meanwhile, on the customer side, we are seeing many RFPs released to lease land. Often the land is surrounded by wetlands, in protected areas, and heavily forested. When land is being positioned for a solar lease, these restrictive qualities should be contemplated and addressed by the land owner, especially with regards to the removal of mature trees. Our suggestion for potential solar customers is to look closely at the new land use regulations under SMART and also offer a plan for tree removal, if required – or work closely with a developer that can help you understand.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered 650MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.